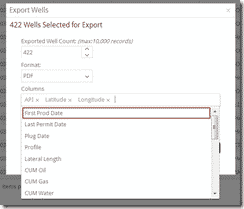

Exporting Datasets

One of our biggest requests has been the ability to export data from our database to use in other software for further analysis. Fortunately,...

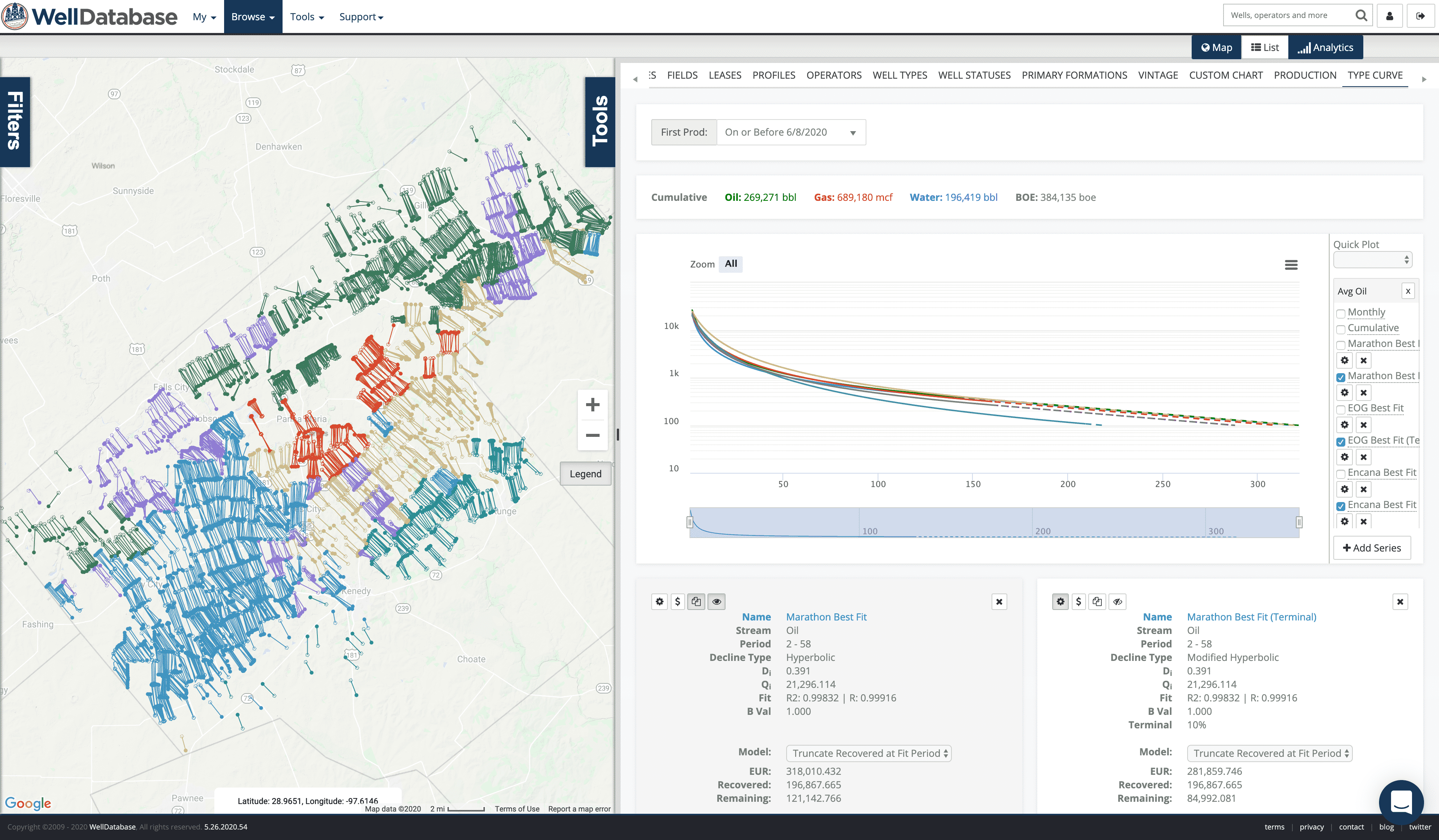

You need data. You need mapping. You need tools to analyze that data. Now you can do everything in a single, easy to use platform.

Perfect for users who need access to basic well level data. If you're only interested in a few wells and currently use state sites, this plan is for you.

The industry didn't start with unconventionals and neither does our data. We cover the full historical dataset across every producing state and province. Don't settle for inferior data, check out our coverage for any state or province you're interested in.

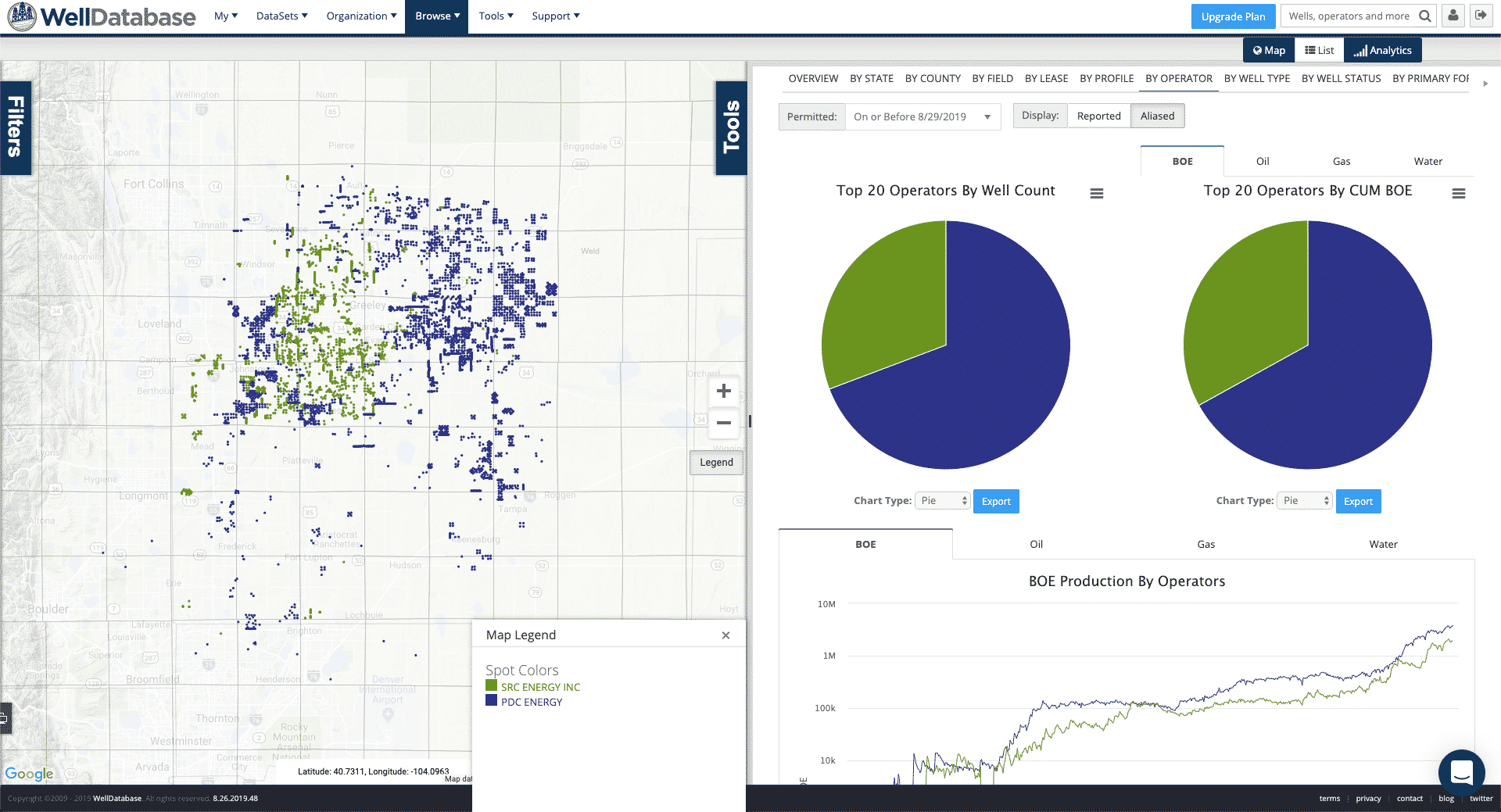

There’s a lot going on in M&A lately. A trend we’re likely to see increase in the coming months. WellDatabase is uniquely suited to perform deal analysis. The platform enables you to quickly find the data you need and perform analysis in minutes. Here we’ll spend a few minutes reviewing the SRC Energy & PDC Energy merger.

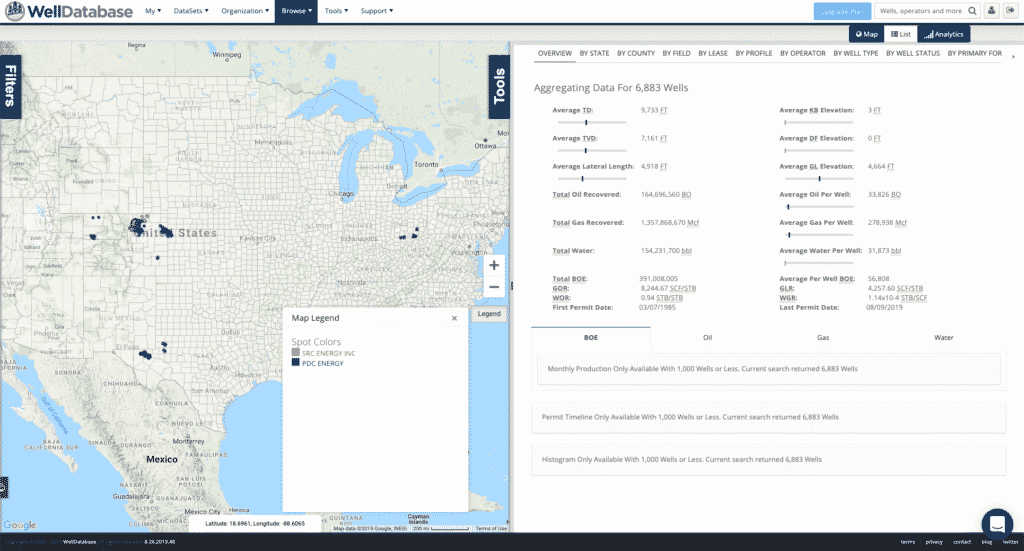

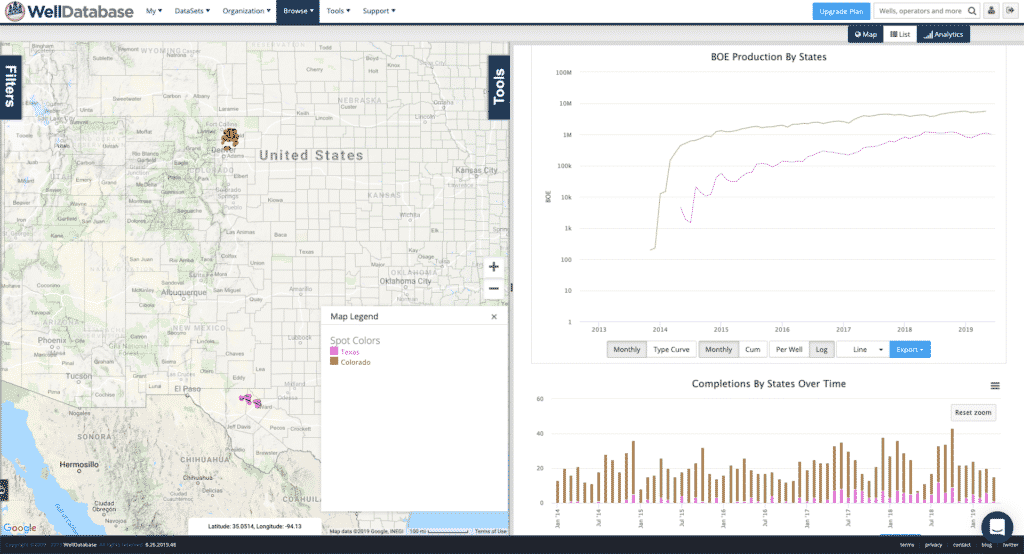

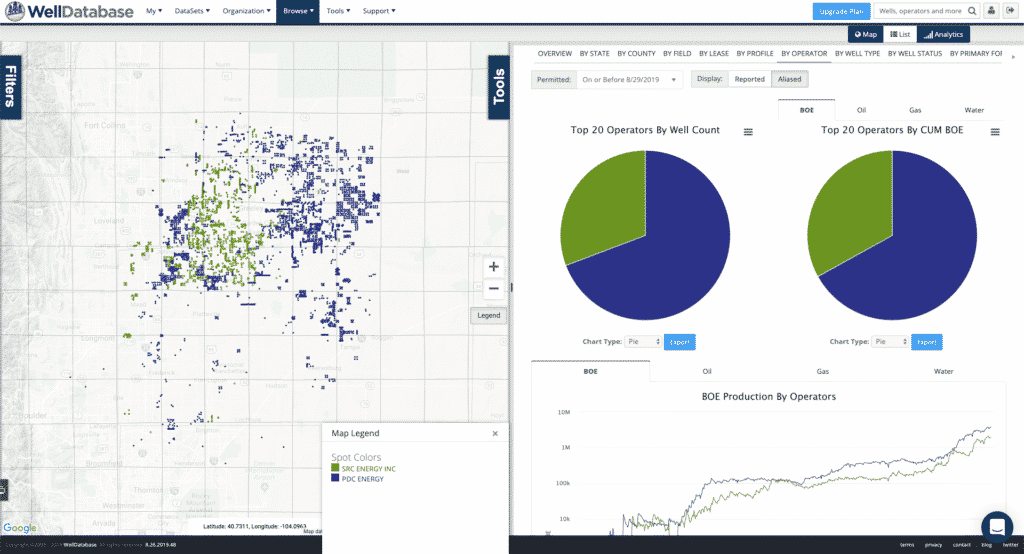

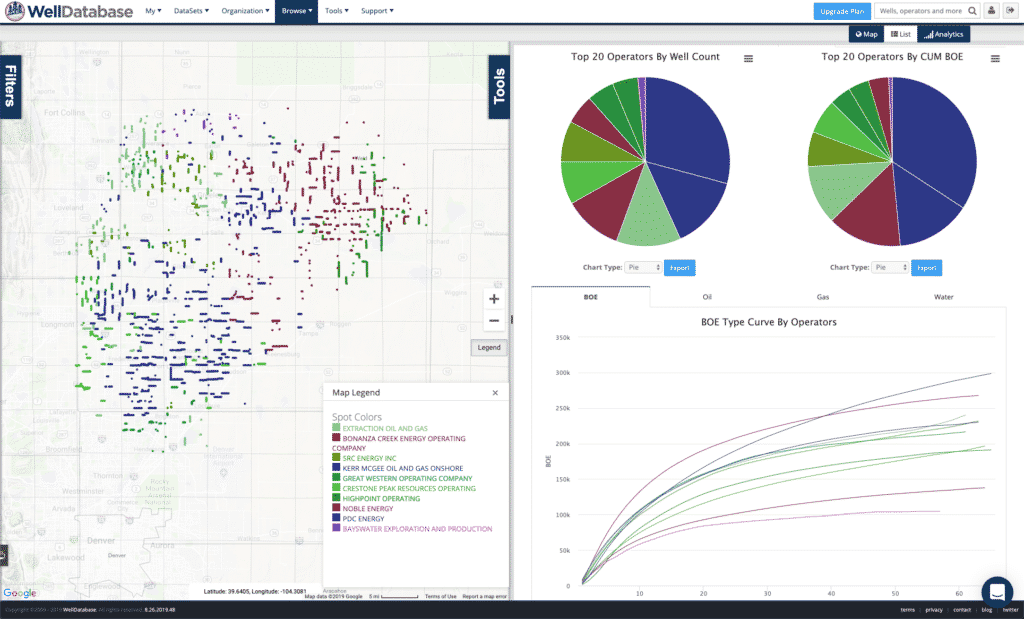

The first step is to find the wells we’re interested in. In this type of deal, we’ll start with a high level view of all wells owned by both companies. We’ll use the Operators – Aliased filter and search for SRC ENERGY INC and PDC ENERGY. We’ll also set our map to color by the Current Operator – Aliased. The map comes back like this:

Now there are a couple things we need to clean up. The PDC assets in Ohio and Kansas were sold off (PDC Energy to Sell Natural Gas Assets & PDC Sells Remaining Ohio Utica Acreage). The wells that remain assigned to PDC are dry holes or previously plugged and abandoned wells. Many times states do not bother to update the current operator in these situations. Since we know that PDC & SRC’s wells are exclusively in CO and TX, we’ll just filter to those two states. We’ll also filter down to producing wells. Now our map looks like this:

Comparing these operators and what they look like combined is the primary goal here. Before we do that, let’s take a second to look at PDC’s activity as of late. Specifically TX vs CO development. To do that, we’ll just exclude SRC for a minute and limit the search to wells that have come online since 1/1/2014. We’ll so swap Color By over to State.

Search – PDC Wells in TX & CO since 1/1/2014

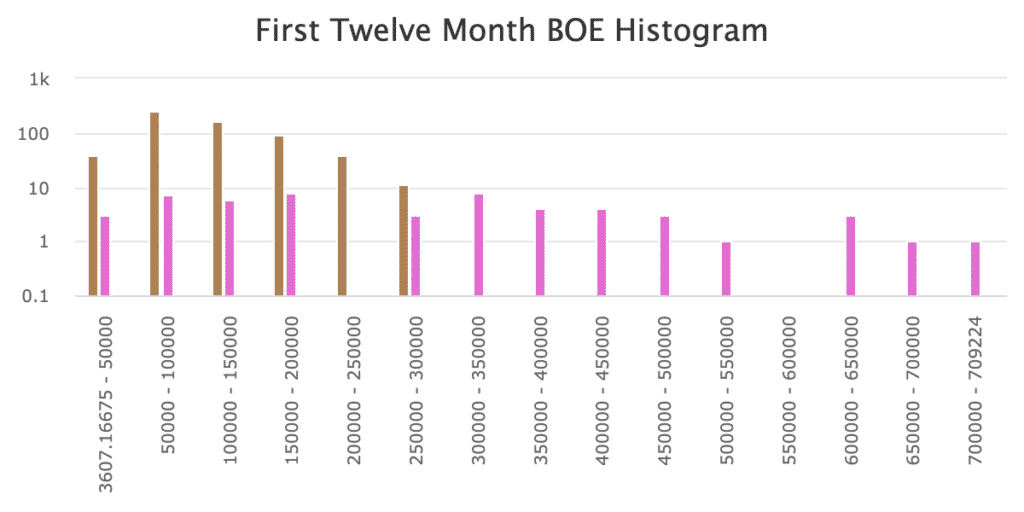

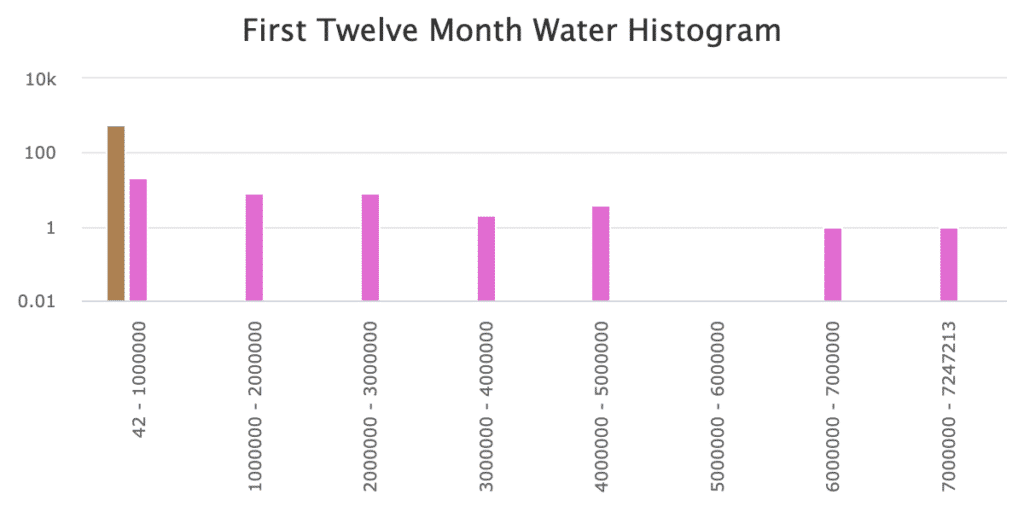

Few items to take away

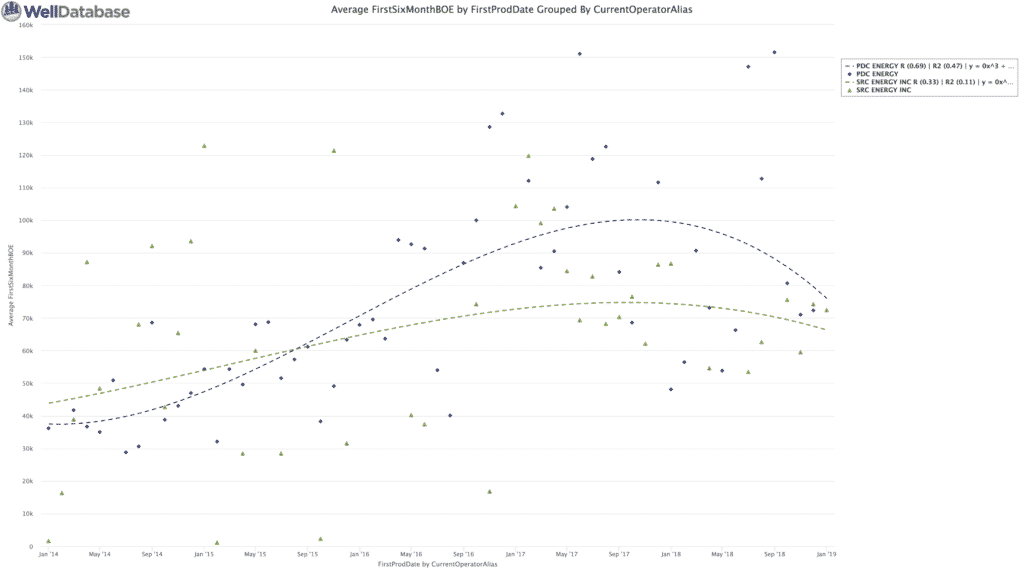

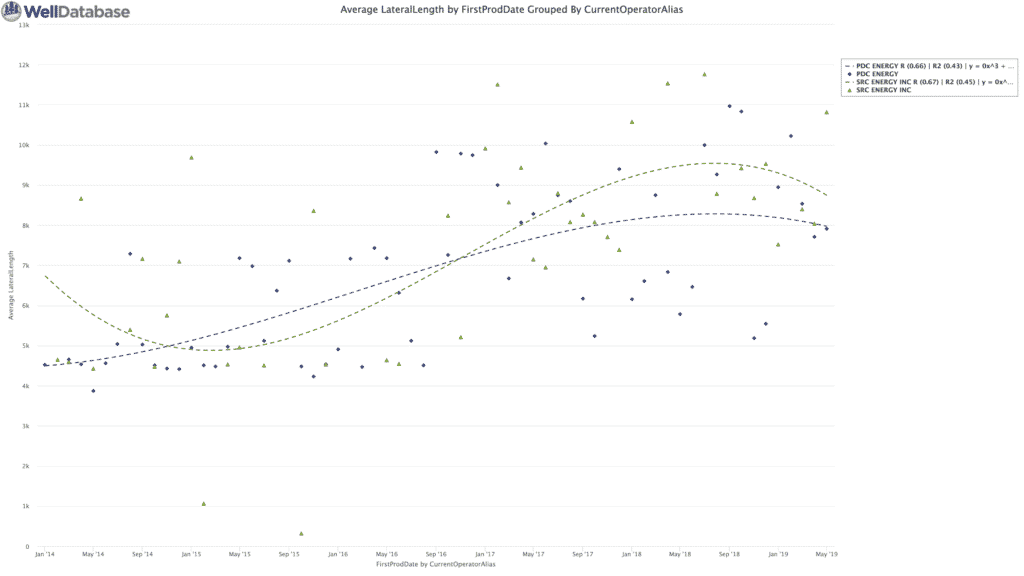

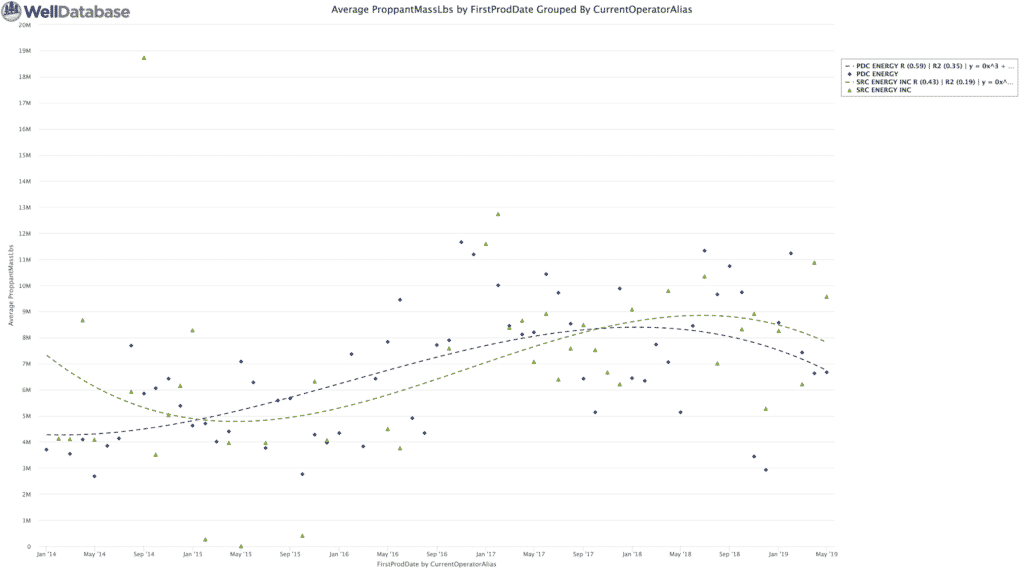

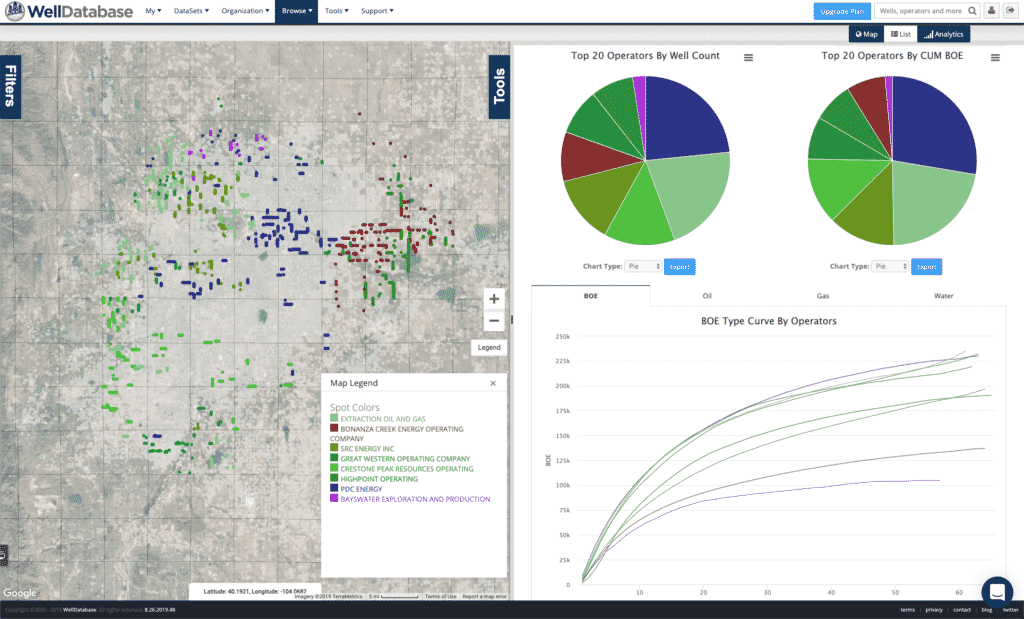

So the real interesting part in evaluating a merger like this is comparing the activity between the two operators. PDC and SRC have been very active in the Wattenburg field with adjacent acreage. This makes comparing these two pretty easy in WellDatabase.

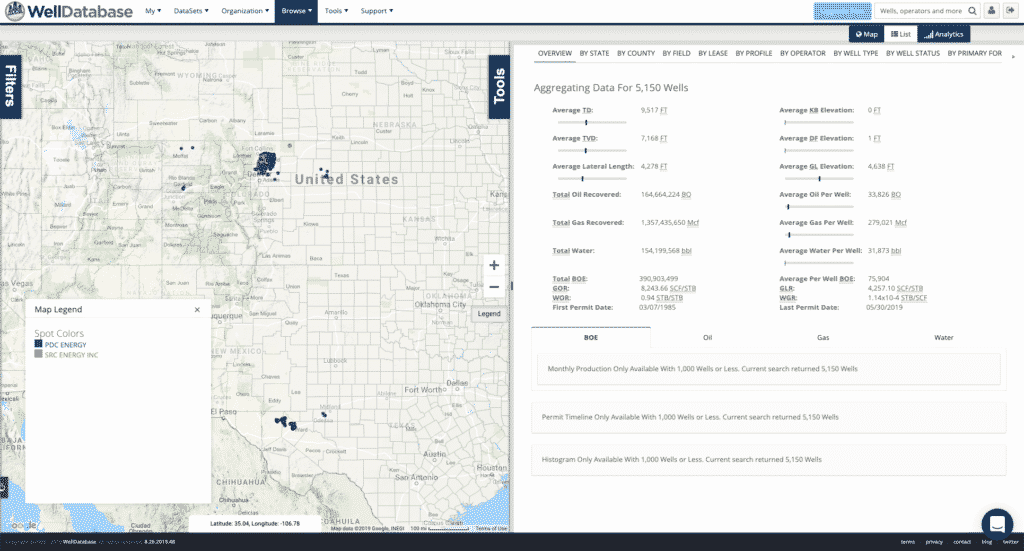

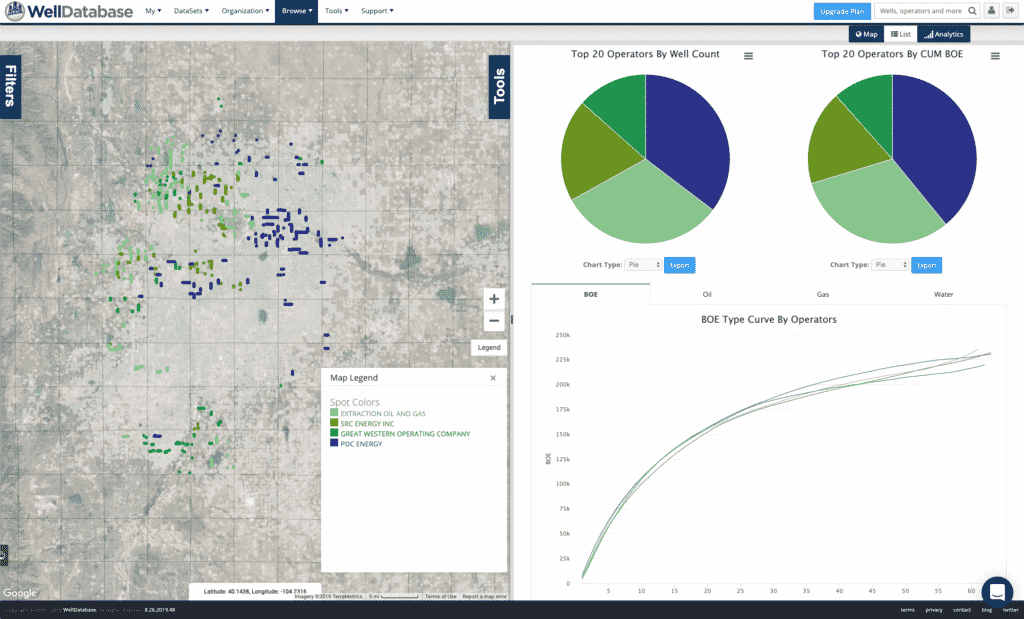

First, we’ll change up our filters to now show all wells for PDC and SRC and use Wattenburg as the field. We’ll also flip the color by back to Current Operator – Aliased.

Another link to the search for those following along – PDC & SRC Wattenburg

Both companies operate wells that have been producing for 40+ years. In order to understand how well these companies line up, we’ll go ahead and only look at wells drilled in the past 5 years. All we need to do is add 1/1/2014 into the First Production Date filter.

Here’s that search – SRC & PDC Wattenburg Last 5 Years

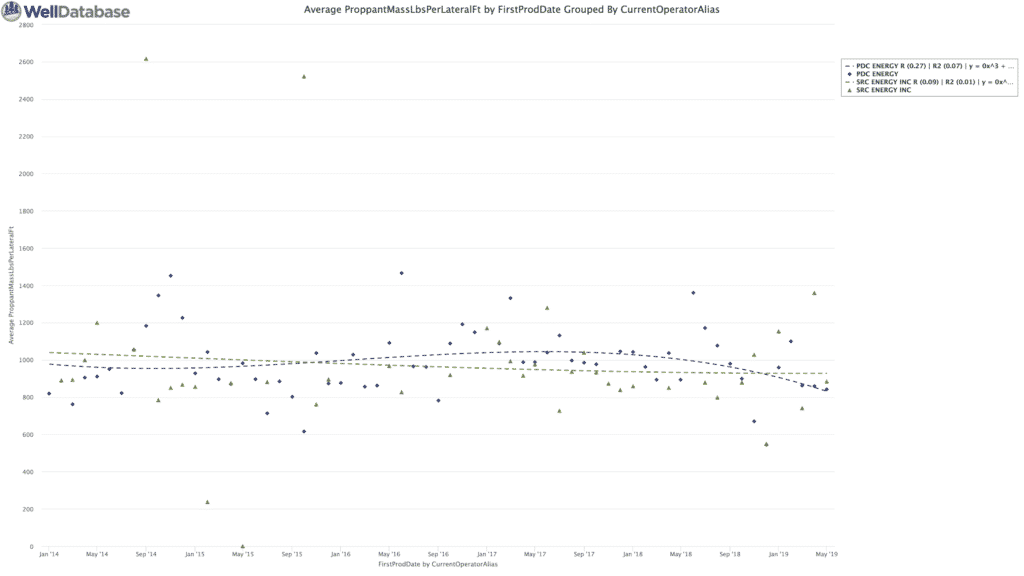

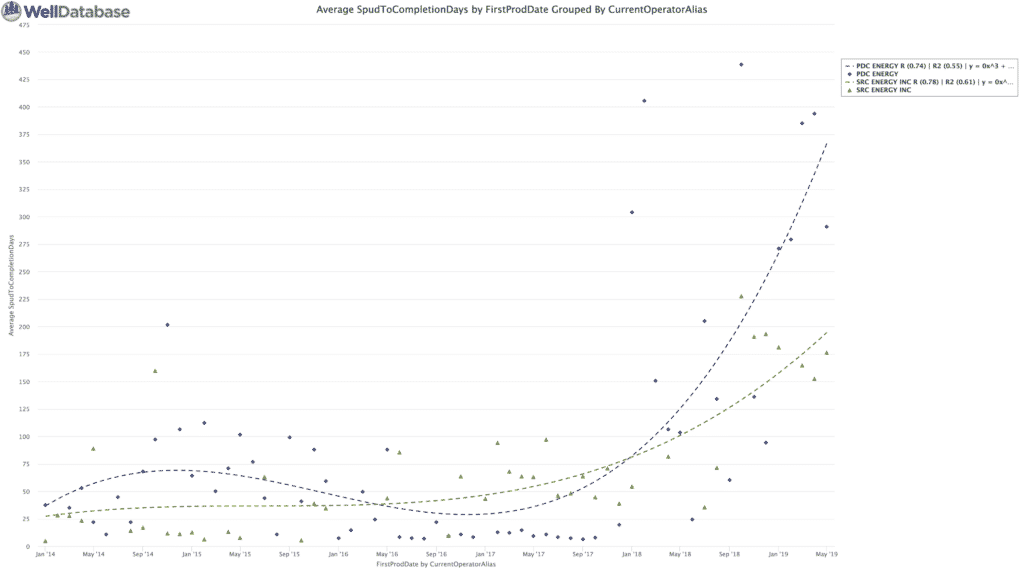

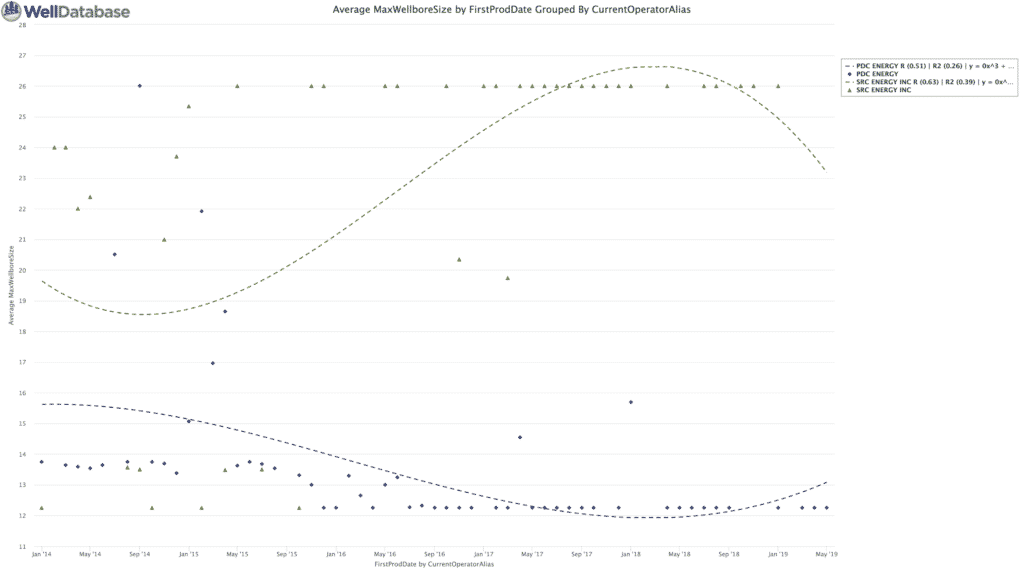

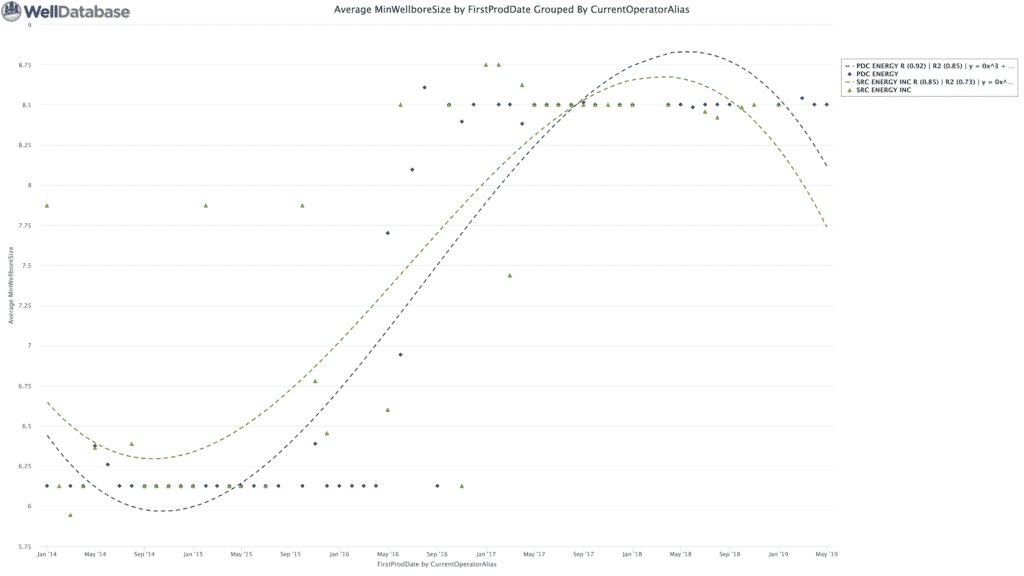

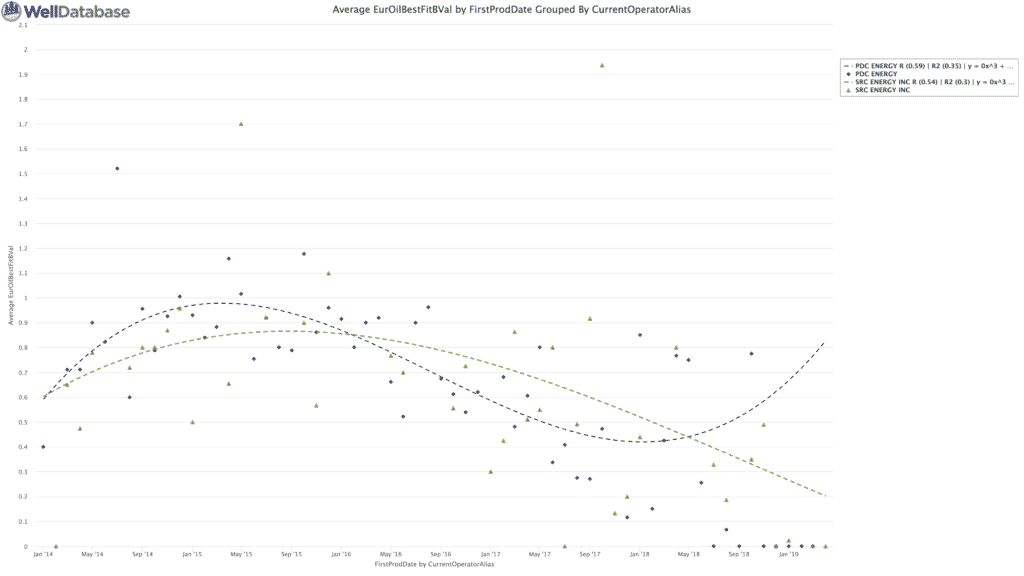

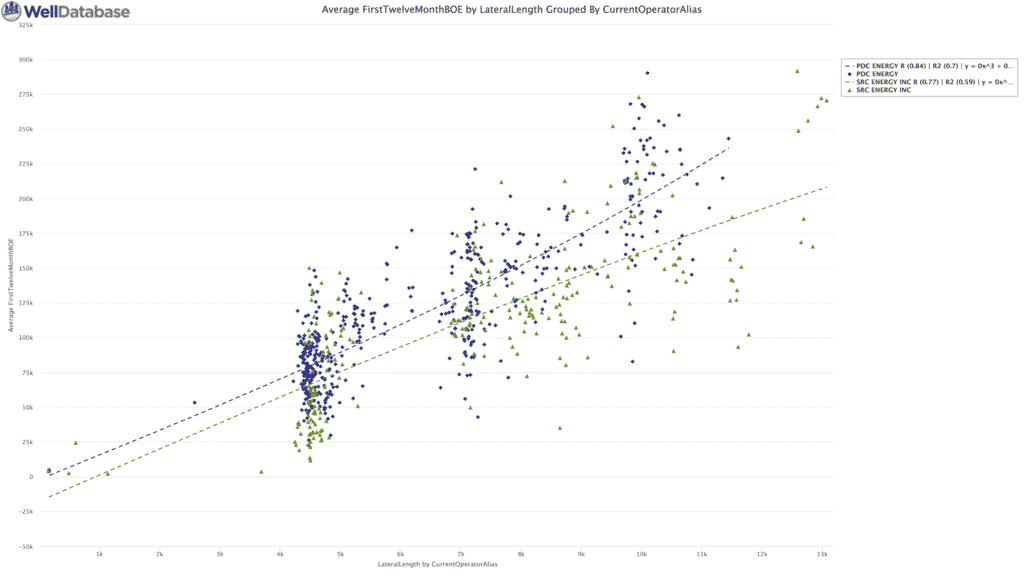

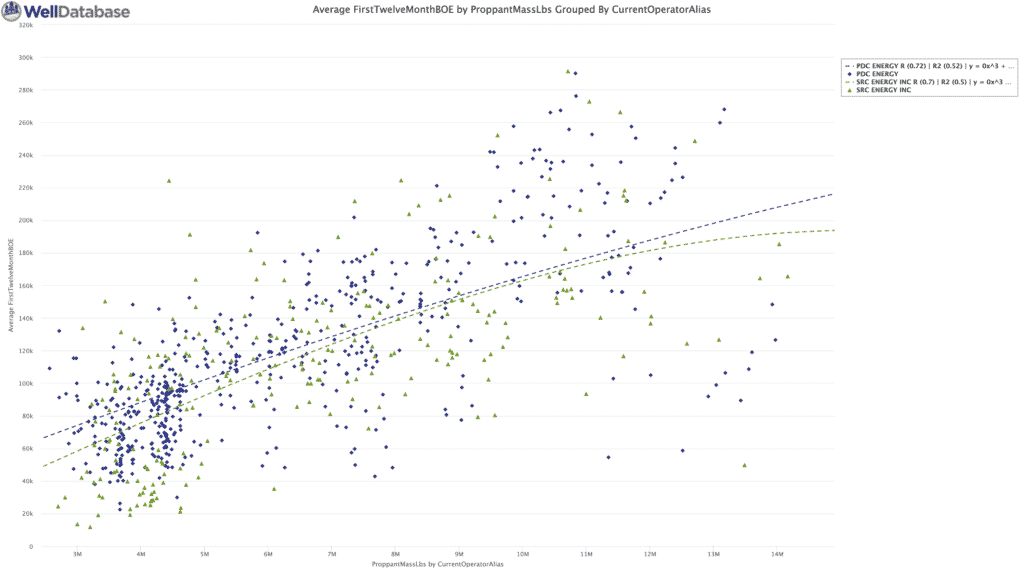

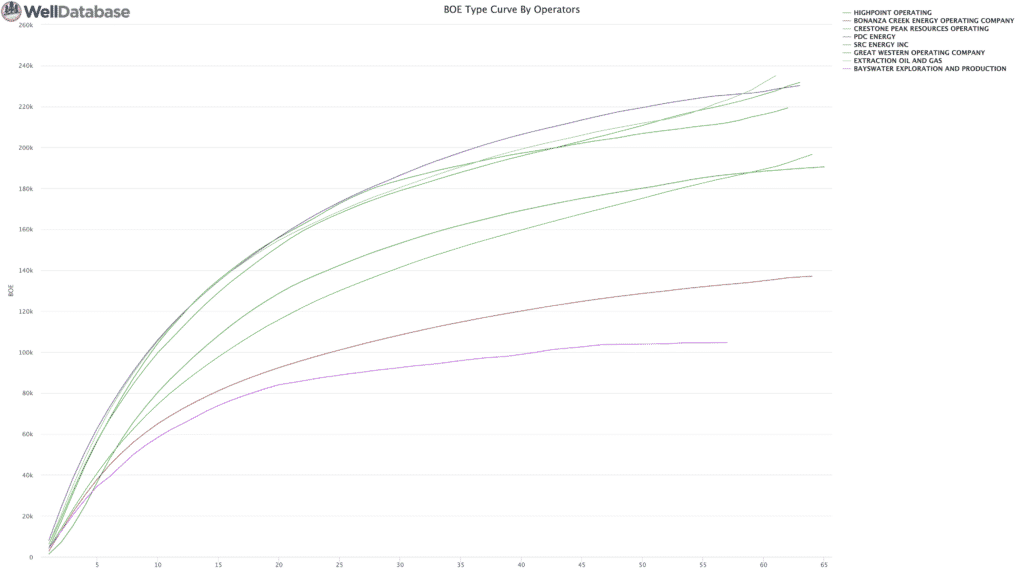

Now there is a slew of things we can do. We’re just going to drop in a handful here.

We could keep going, but the jist is that these two companies should make for a good merger. They basically look like the same company already. The combo should produce more of the same with a potential savings in G&A.

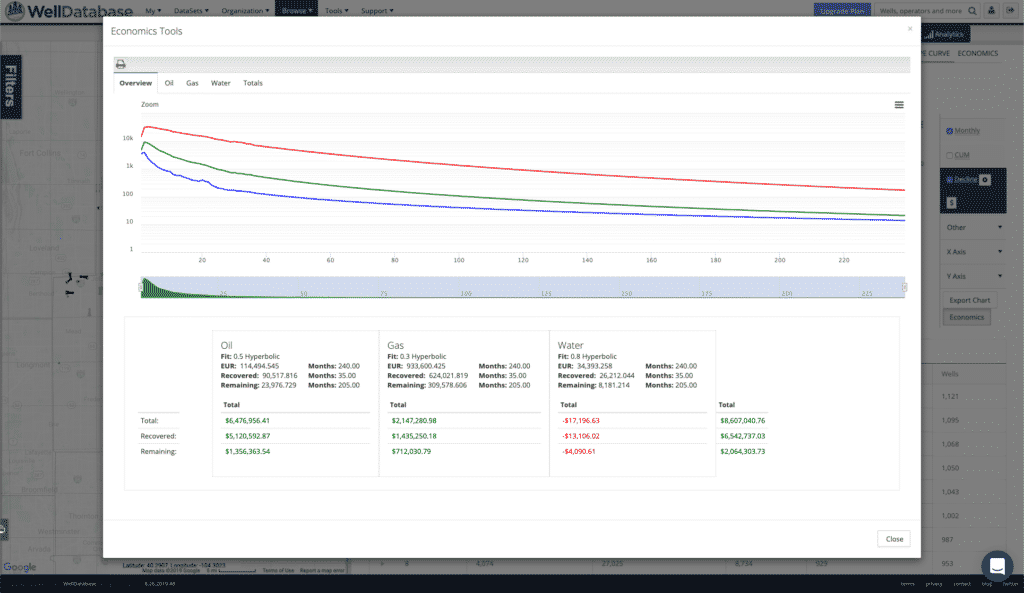

The combined companies basic 20 year economics look like this

That’s about it for this blog. Everything you see here is available in WellDatabase. Honestly, it took me longer to type this blog than it did for me to generate the plots & maps above. If you haven’t tried WellDatabase, today would be a good time to start.

One of our biggest requests has been the ability to export data from our database to use in other software for further analysis. Fortunately,...

Out of the 2,435,234 ways to use decline curve analysis, one is to compare operators. Comparing the average type curves for each operator based on...

Facing a challenge in creating captivating visual maps for your presentation? We are here to help you look like the rockstar you are in front of your...