Fitting Decline Curves

Now that we’ve released our updated decline curve analysis tools, it’s time to get into the details. The number one question we get is, “What exactly...

You need data. You need mapping. You need tools to analyze that data. Now you can do everything in a single, easy to use platform.

Perfect for users who need access to basic well level data. If you're only interested in a few wells and currently use state sites, this plan is for you.

The industry didn't start with unconventionals and neither does our data. We cover the full historical dataset across every producing state and province. Don't settle for inferior data, check out our coverage for any state or province you're interested in.

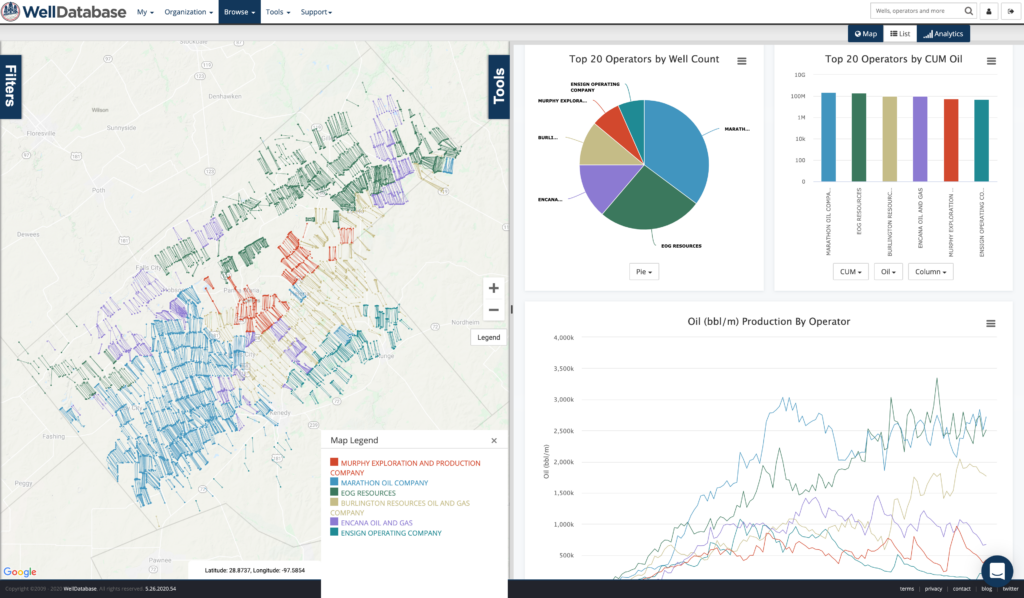

Out of the 2,435,234 ways to use decline curve analysis, one is to compare operators. Comparing the average type curves for each operator based on known production is easy. Unfortunately it leaves questions. Some of those can be answered by generating decline curves.

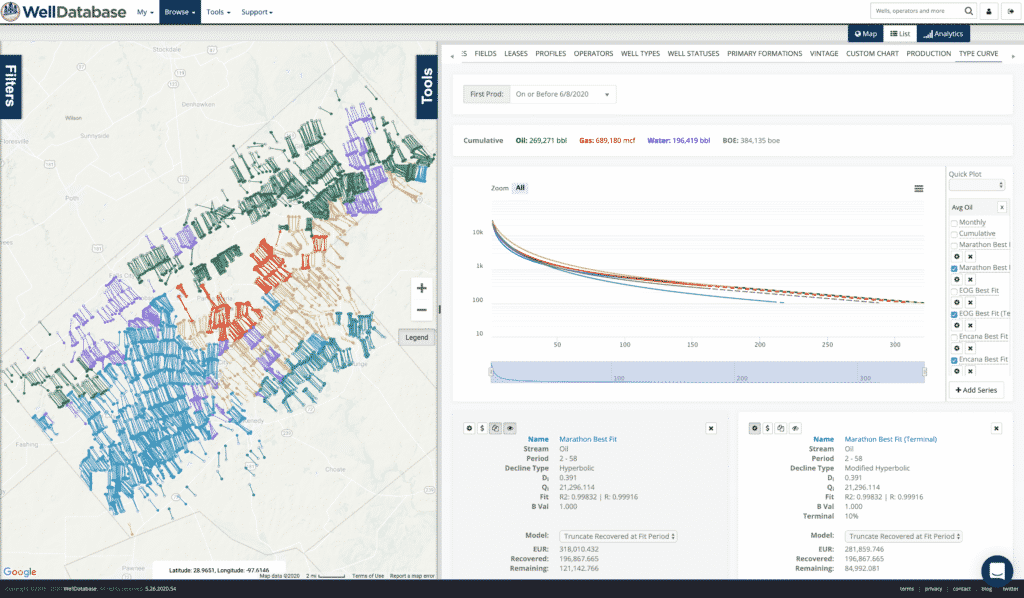

In this example we will look into the top operators in Karnes county, Texas. Karnes is in the heart of the Eagleford play and has a good, established base of wells to work with. We’re also going to focus on oil production. However, this process can be applied on just about any area where you want to rank the operators.

10 points if you get the reference….

We’ll break down the top 6 operators by well count for wells that came online since 2010. In Karnes county, TX, those operators are:

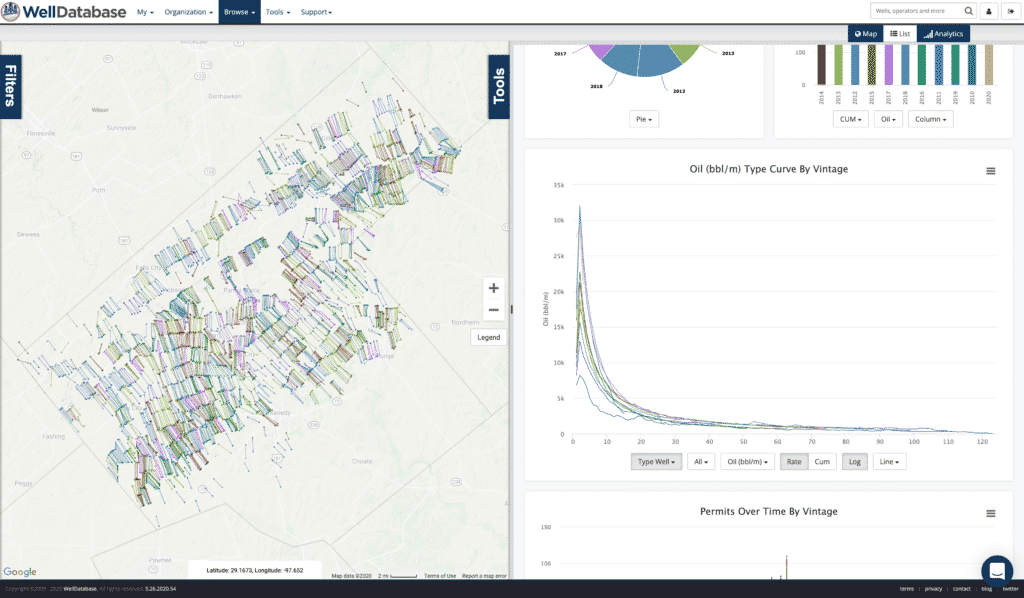

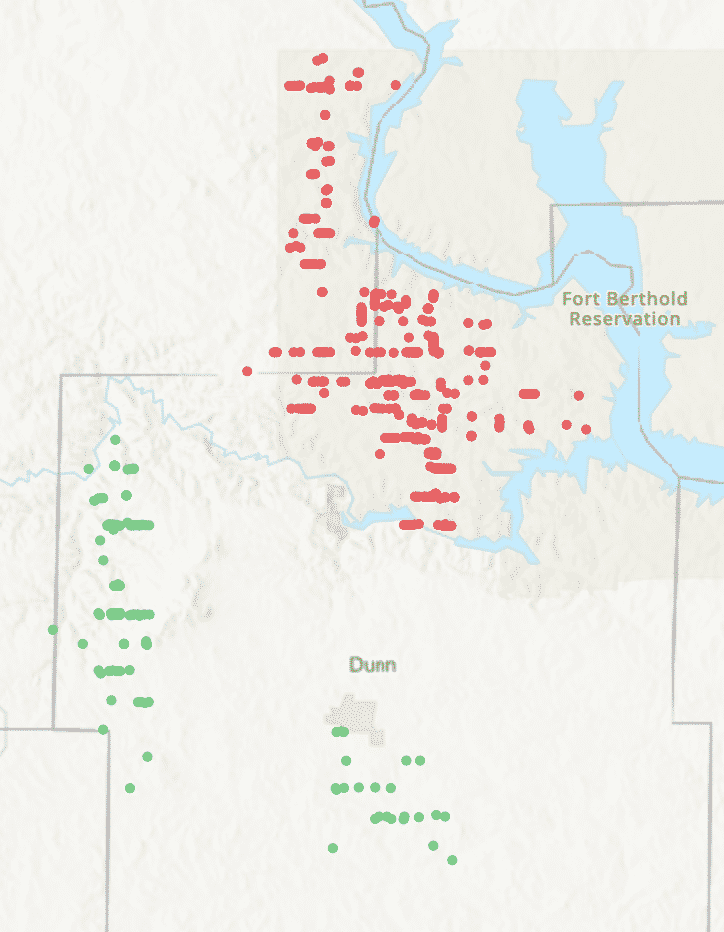

Here is the map of those.

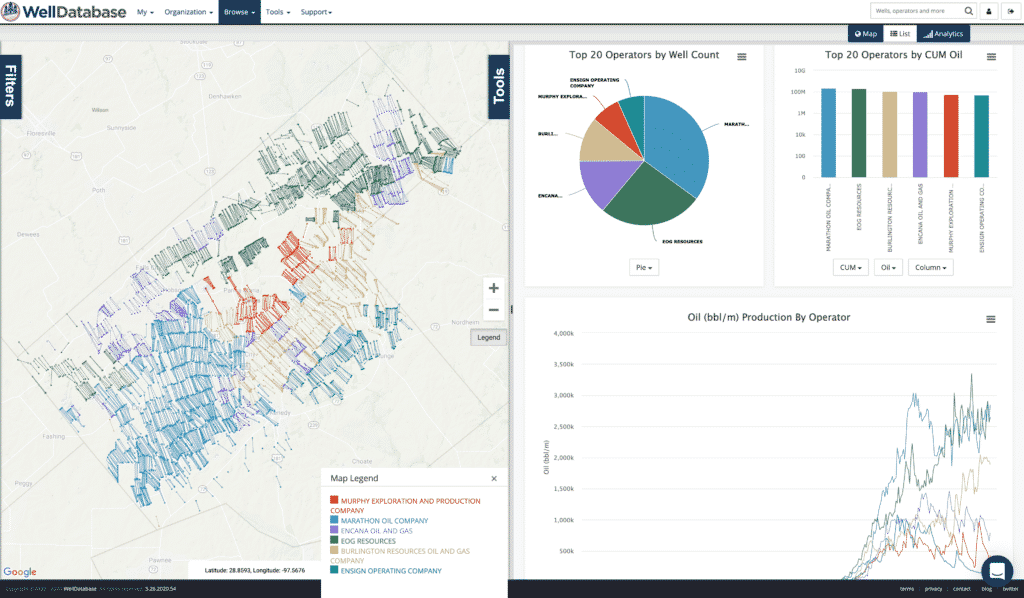

Keep in mind these are wells since 2010. Here is a the screenshot with no date filter.

Since we are comparing production, we’ll stick with wells brought on since 2010.

As a side note (something we’ll dive into in a future blog), the type curve changed decently in 2017. Should always keep vintage in mind when comparing operators.

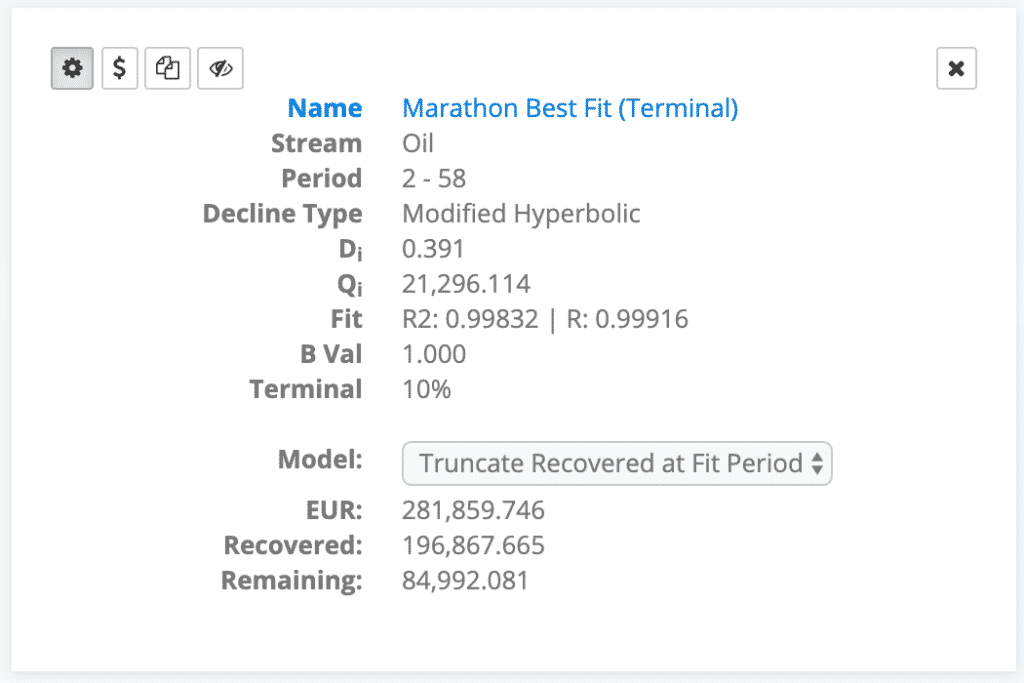

We will be generating a type curve for each operator using our best fit. The fit period will be selected based off the time frame in the type curve where at least 50% of the wells are contributing. Each decline curve will forecast monthly volumes to 50 years or 100 bbls/month, whichever comes sooner. Where terminal decline is not achieved based on the fit period, we will generate a 2nd curve with a 10% terminal number.

Here we go…

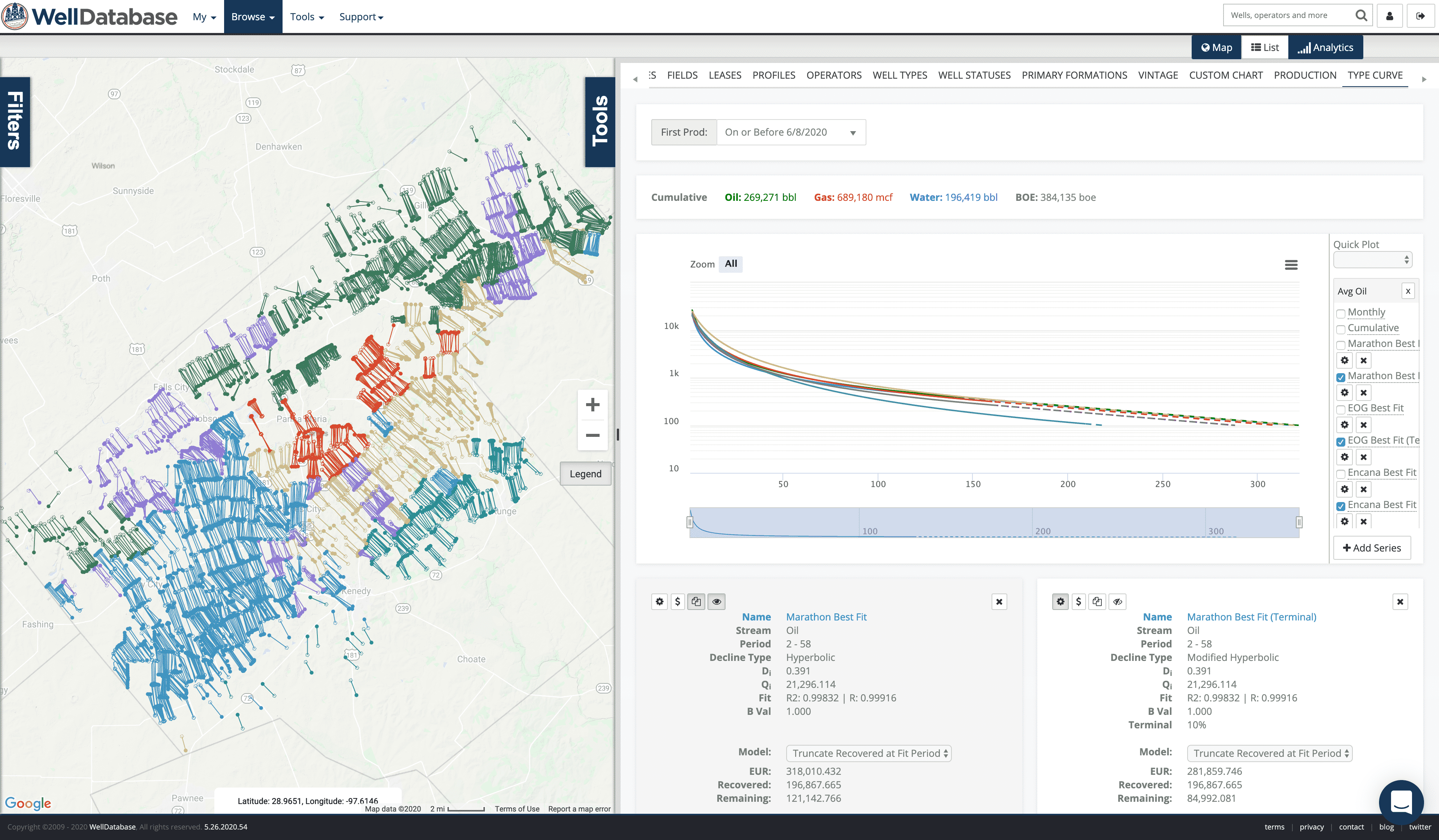

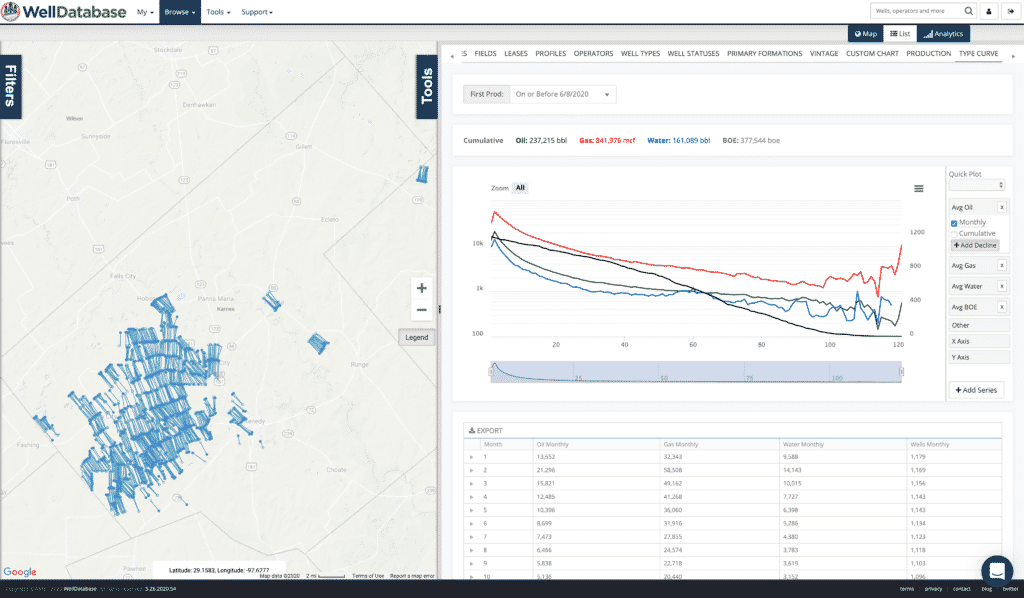

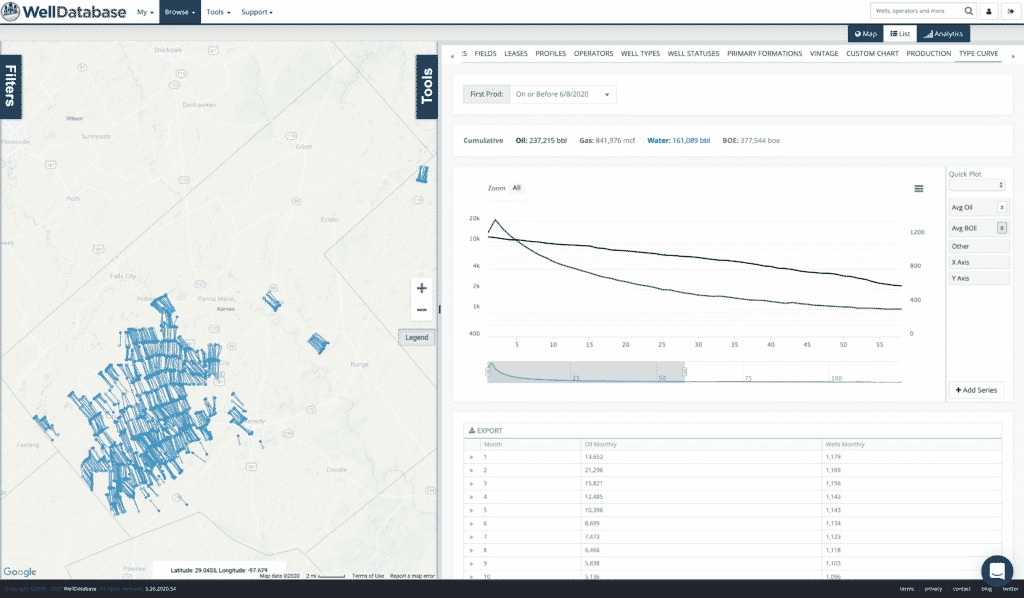

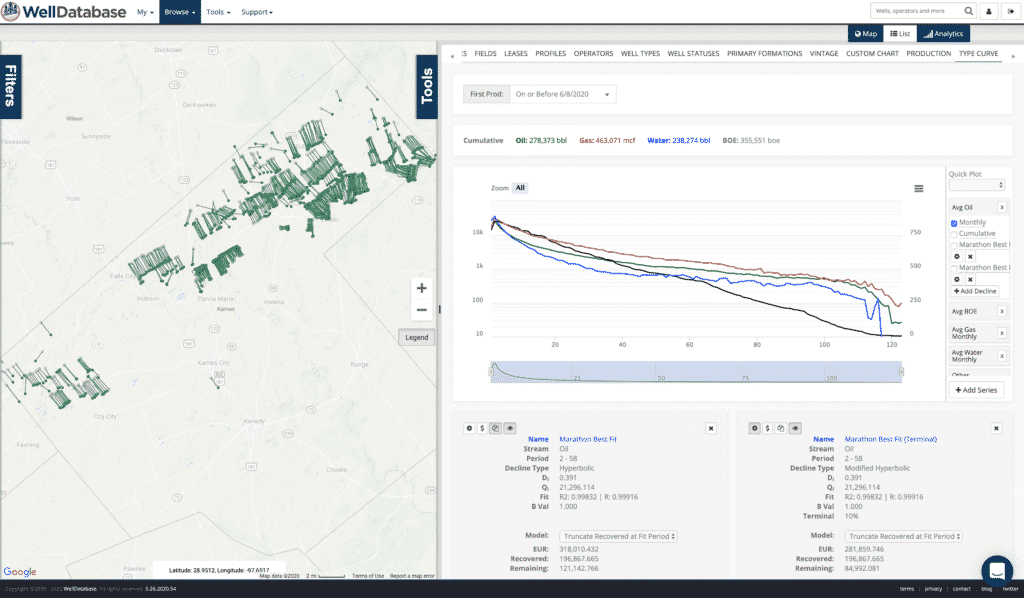

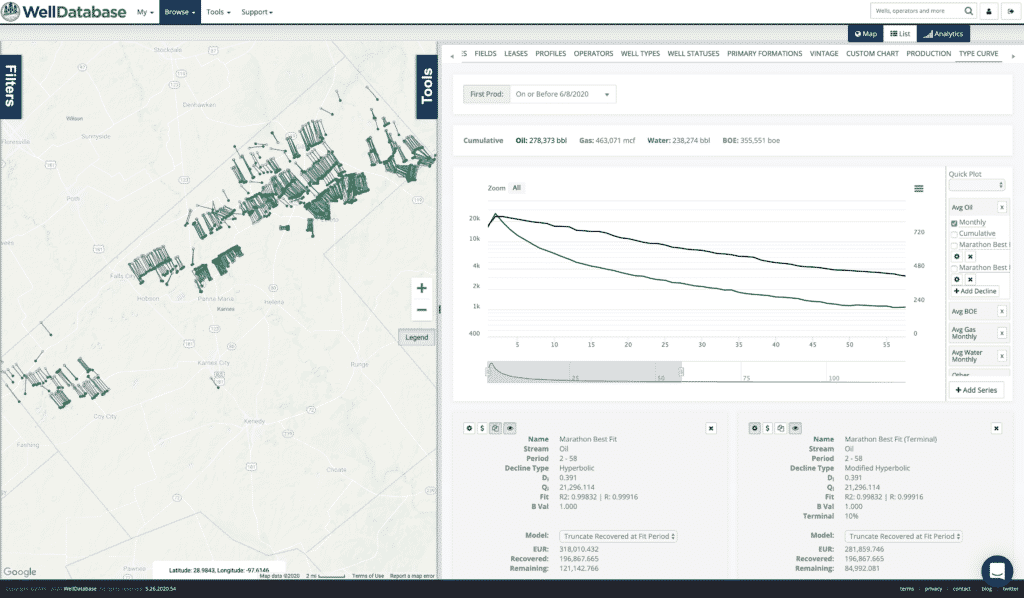

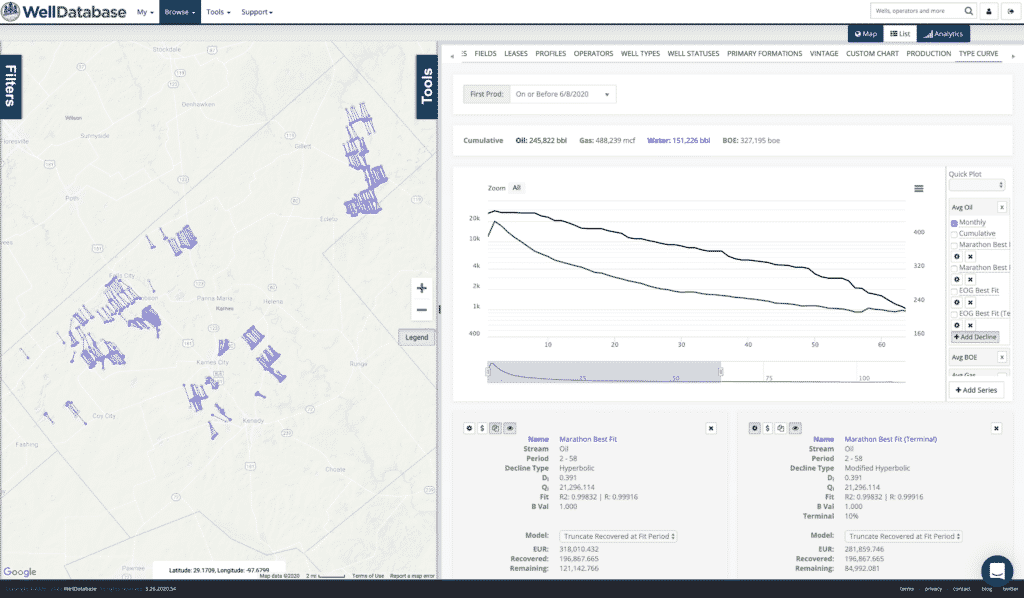

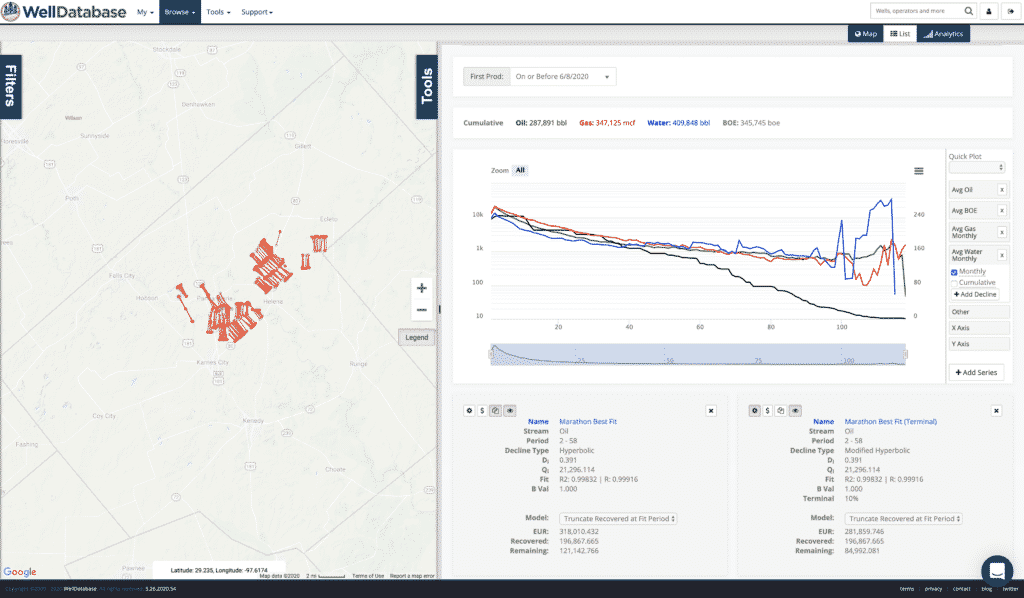

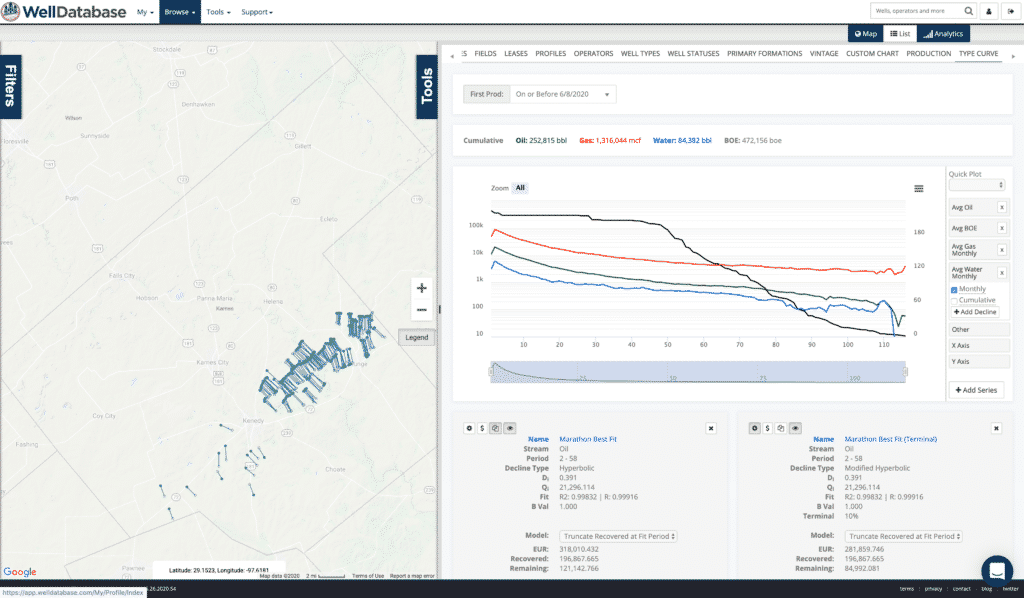

Overall, Marathon’s position and type curves look like this.

The fit period for Marathon is 58 months (600 wells contributing)

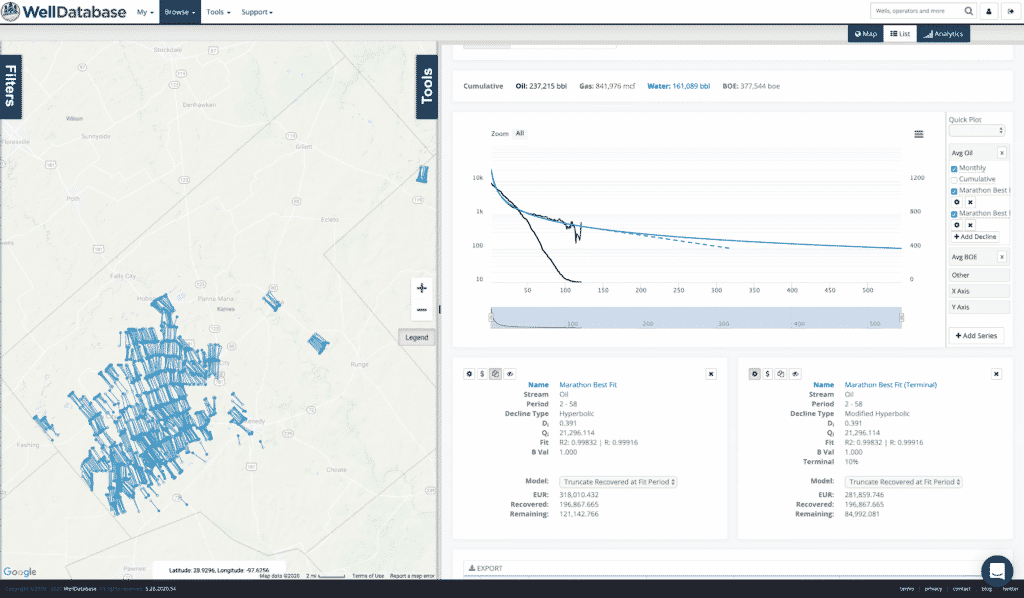

And now the decline. Best fit created curve parameters are:

And like we said, here is the curve with and without a terminal decline.

The difference between the terminal and non-terminal EUR is ~40k bbls. Of course that is achieved with nearly 20 additional years of production. The significance of that is in the eye of the beholder.

We’ll go through the rest of these a little quicker now. Keep in mind we are going to compare these, so we will just be hiding the other company decline curves as we go. You’ll see what I mean.

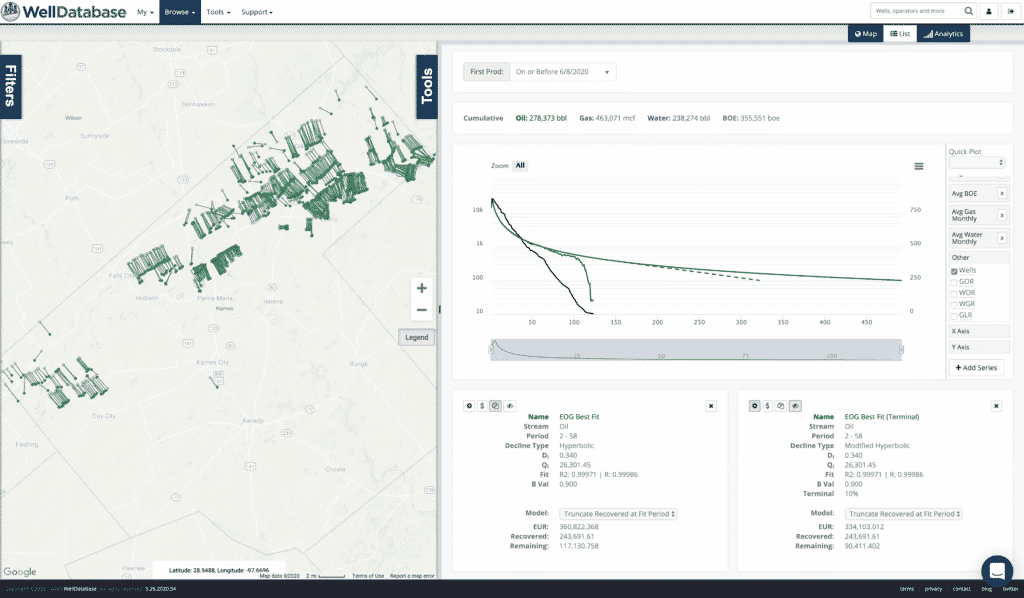

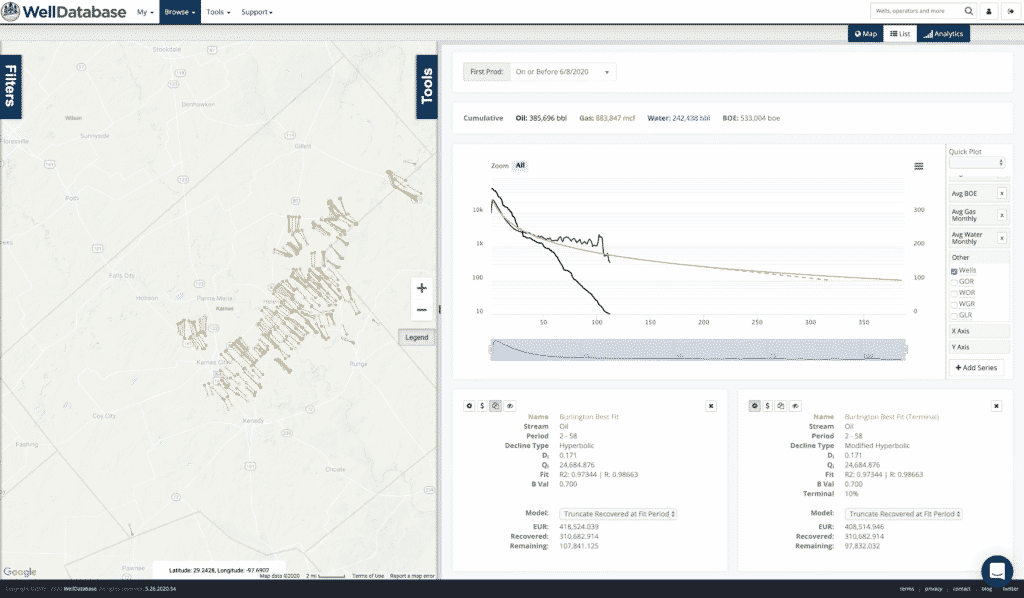

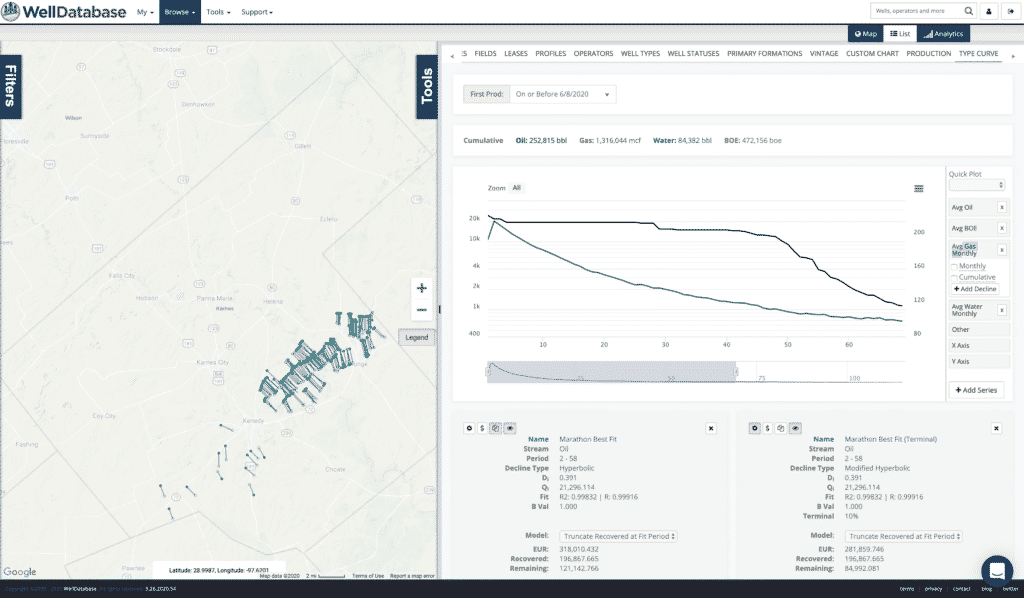

Position and Type Curves.

Another fit period of 58 months

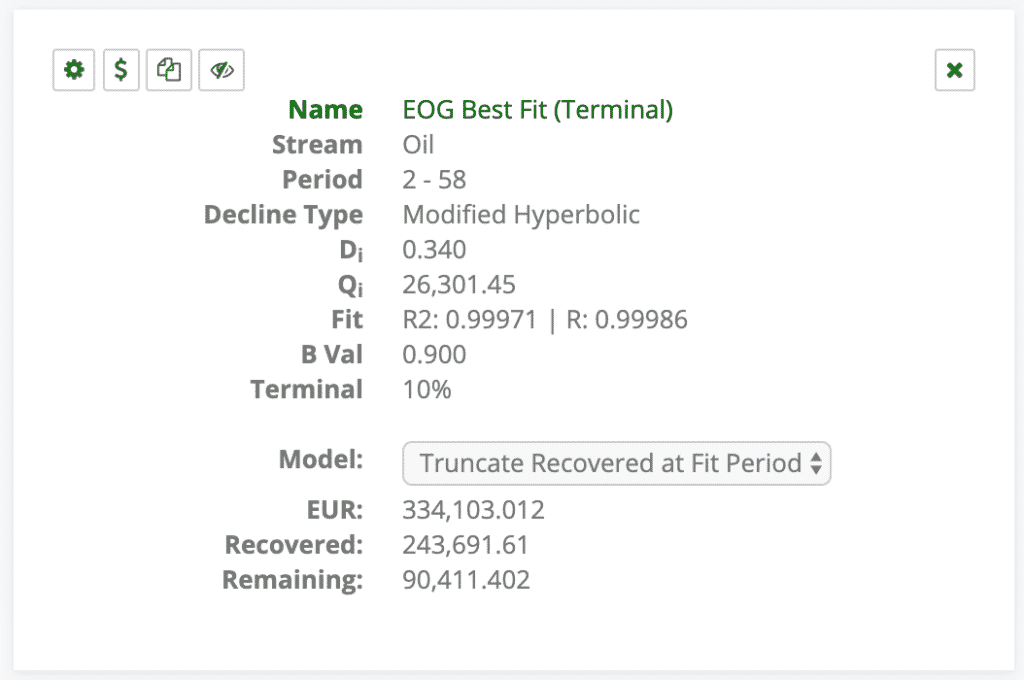

Best fit created curve parameters are:

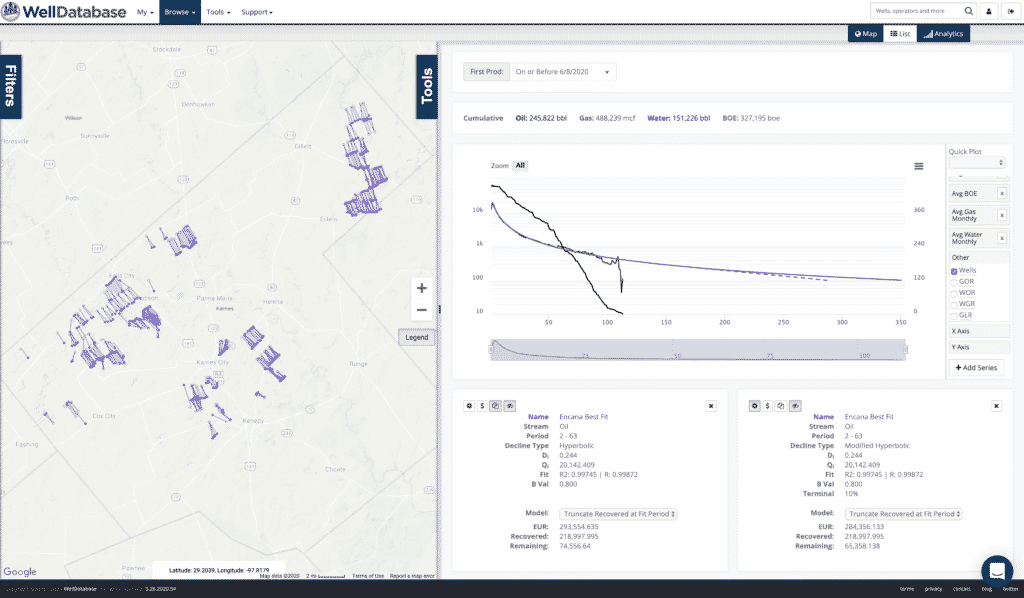

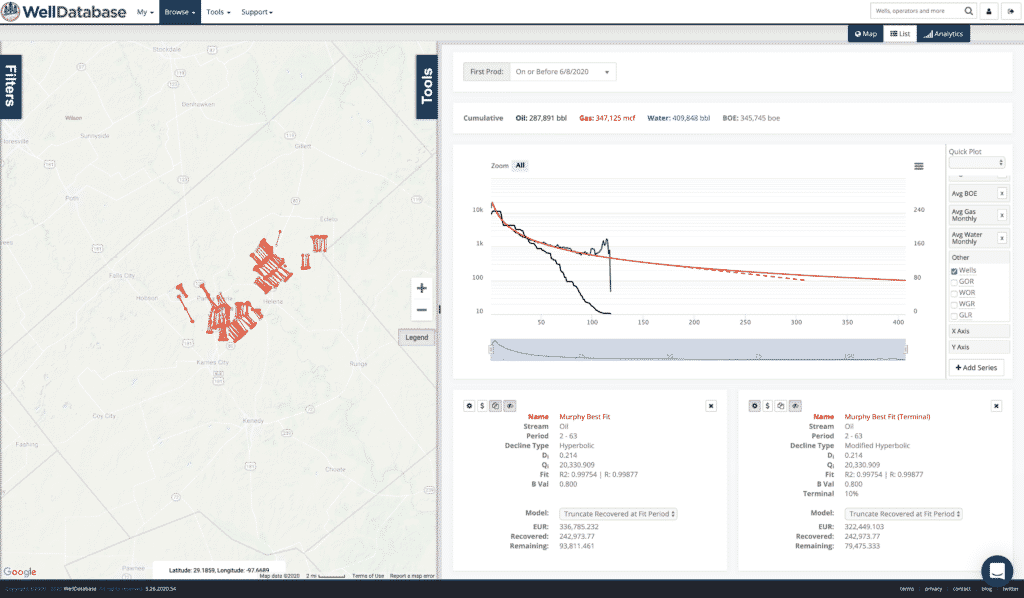

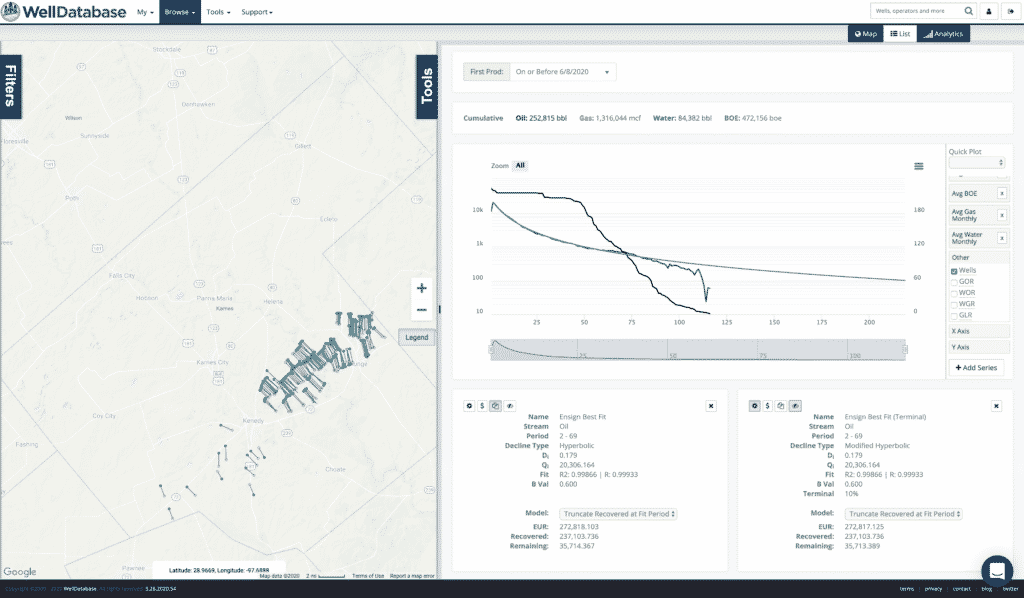

Position and Type Curves

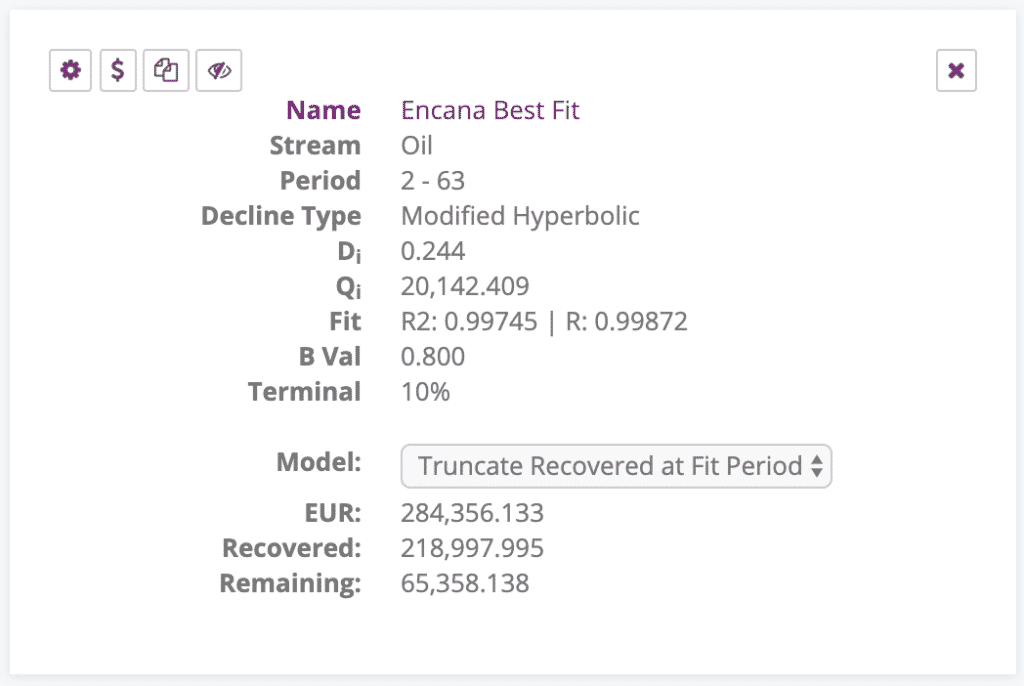

64 months on this fit period

Best fit created curve parameters are:

Position and Type Curves

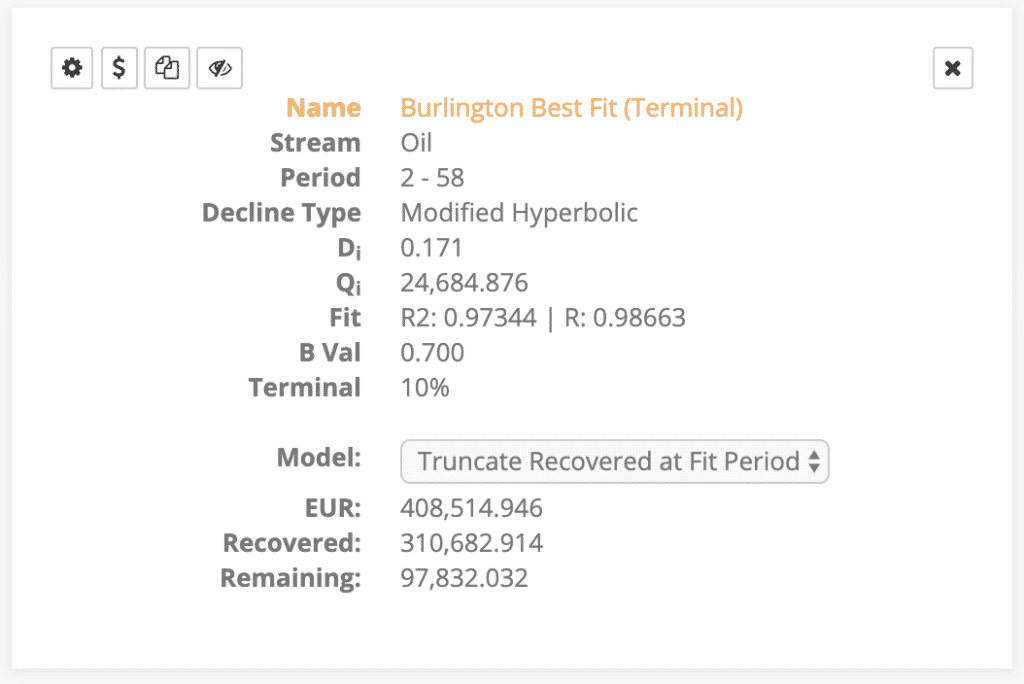

58 months for the fit period

Best fit created curve parameters are:

Position and Type Curves

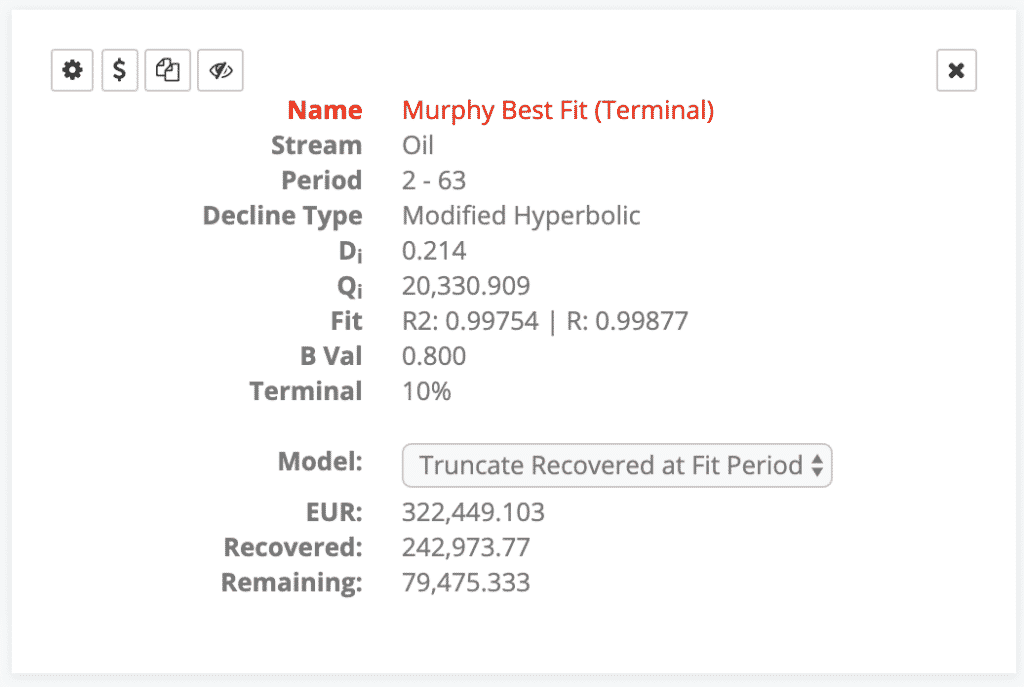

64 months in the fit period

Best fit created curve parameters are:

Position and Type Curves

69 months in the fit period

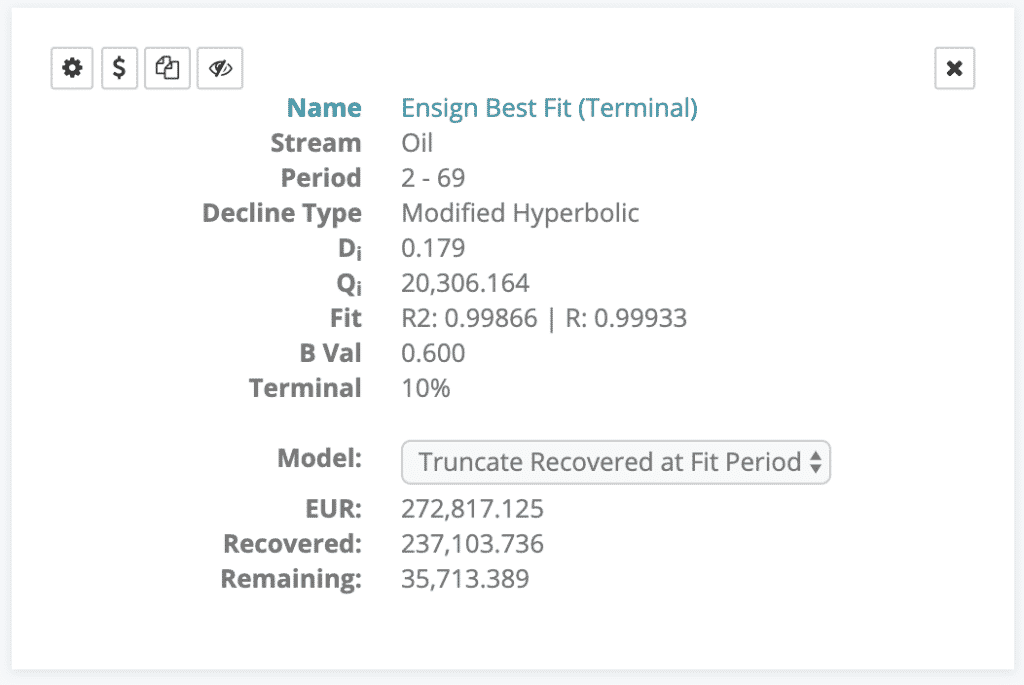

Best fit created curve parameters are:

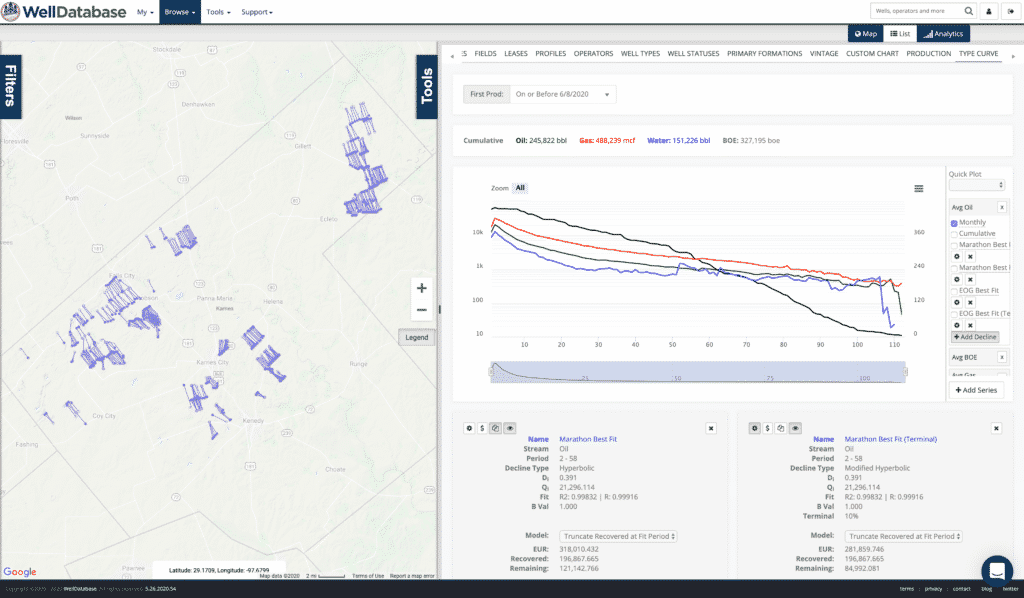

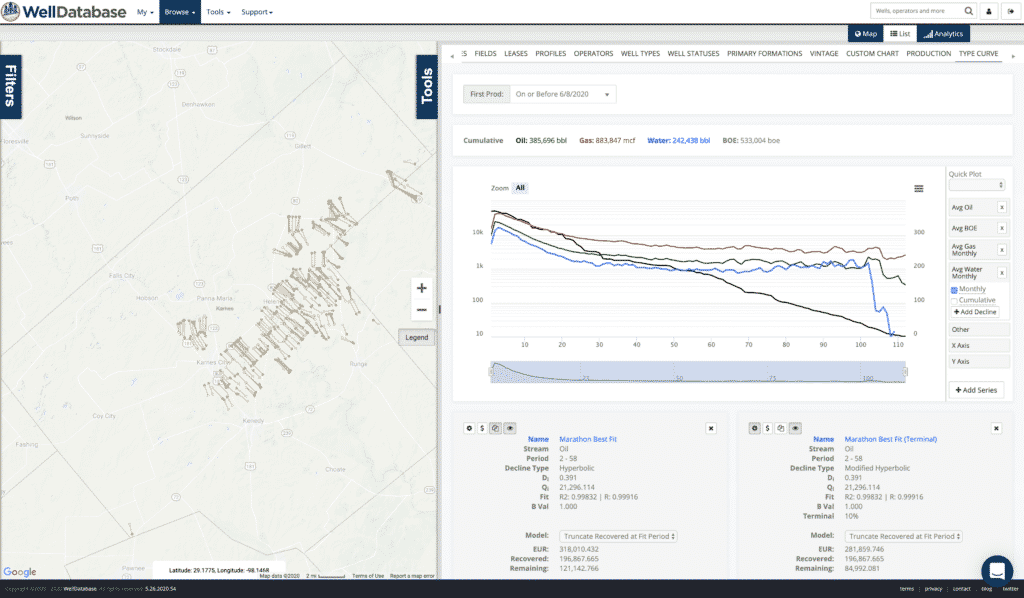

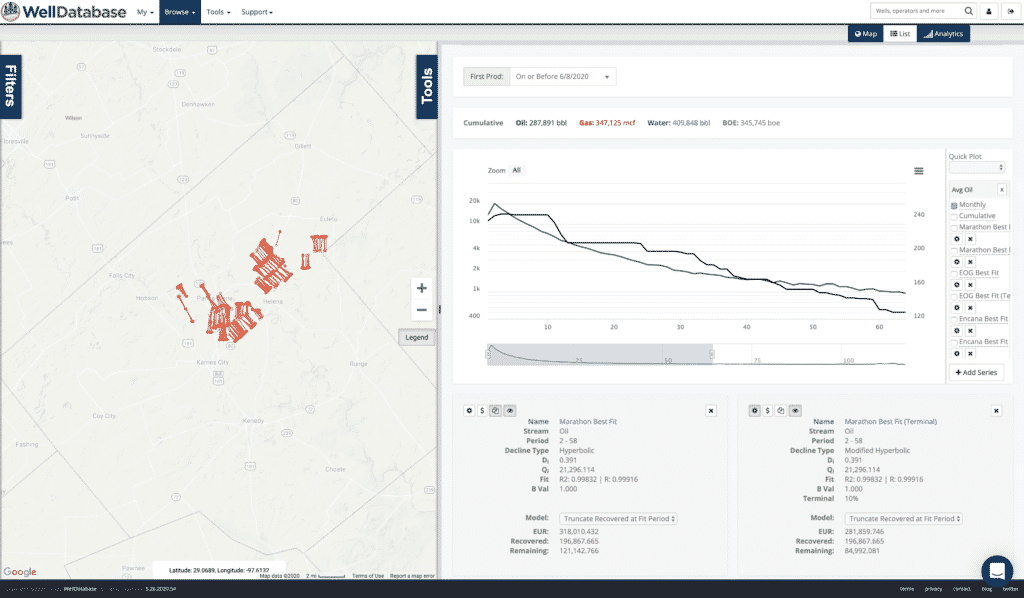

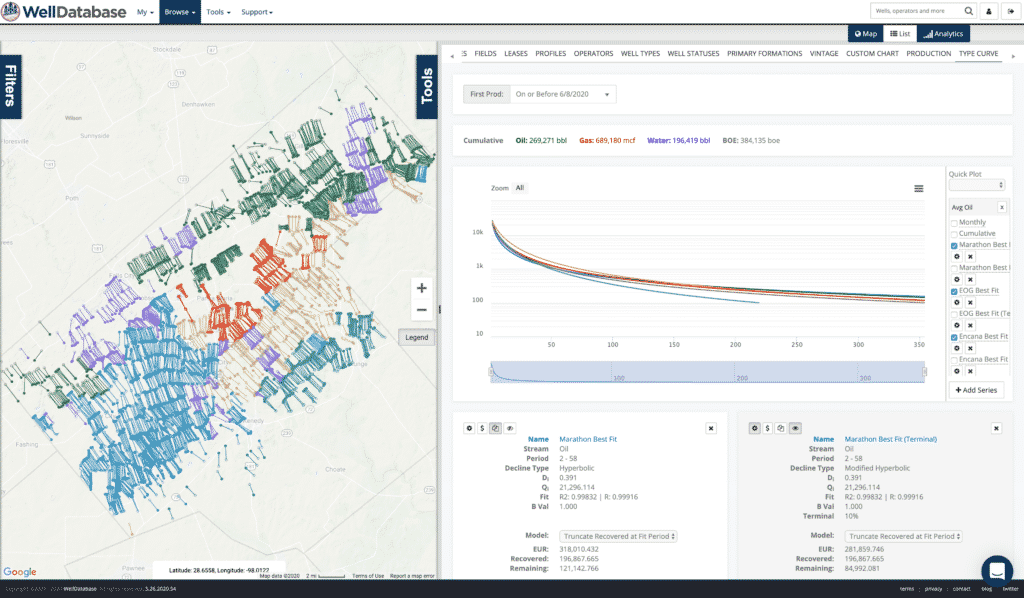

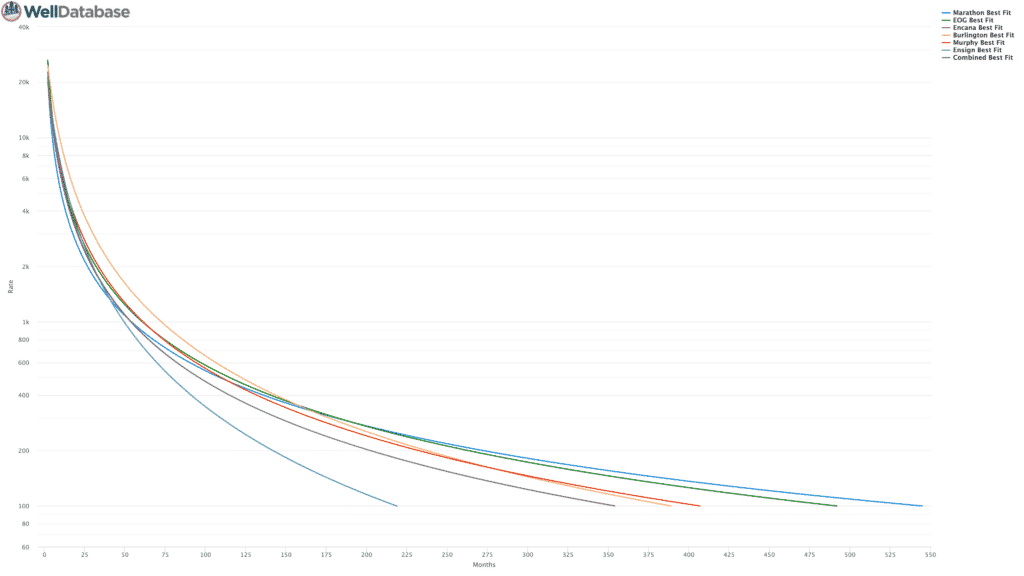

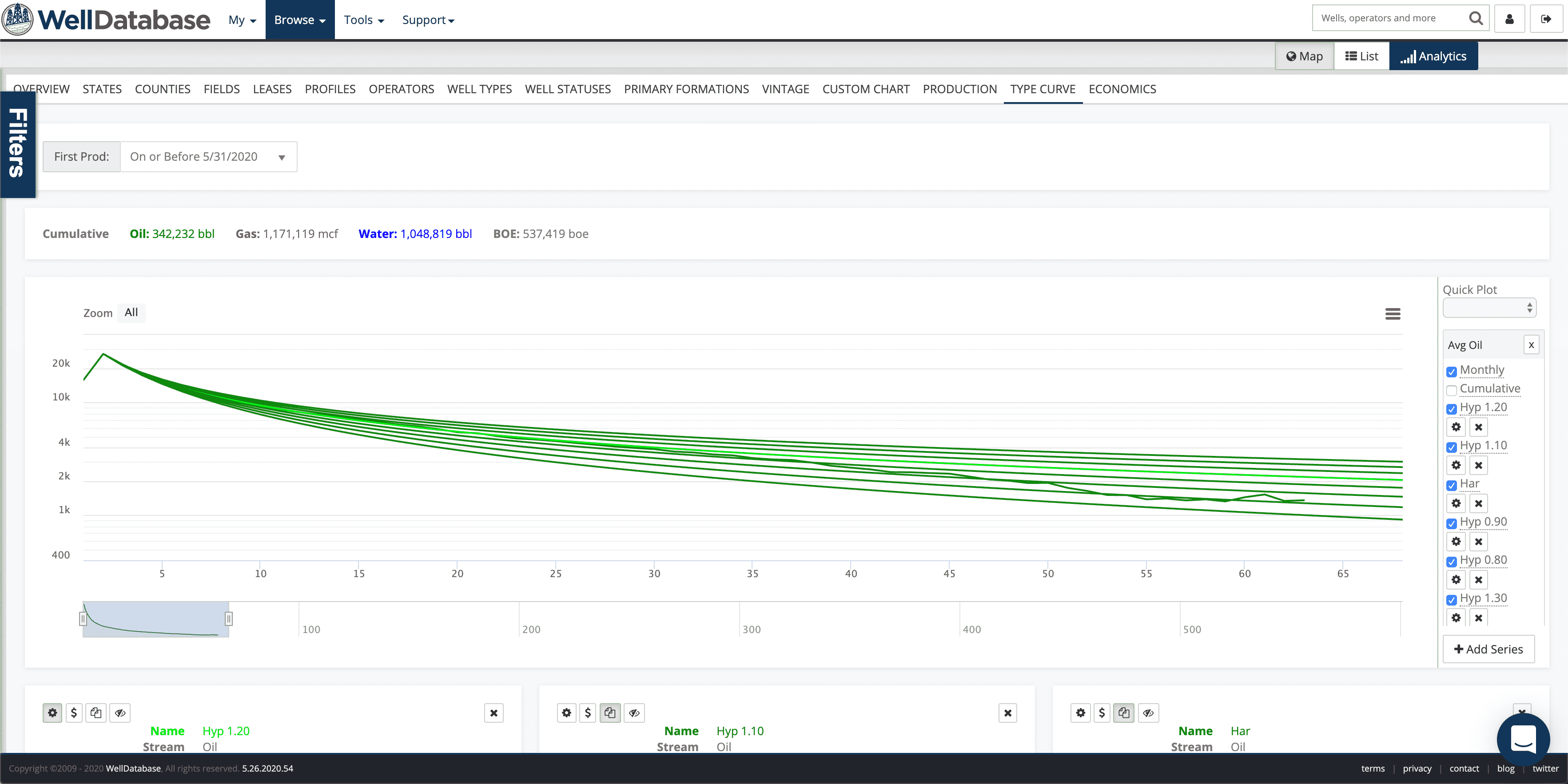

It’s a little messy, but here is what the combined chart looks like for the Best Fit.

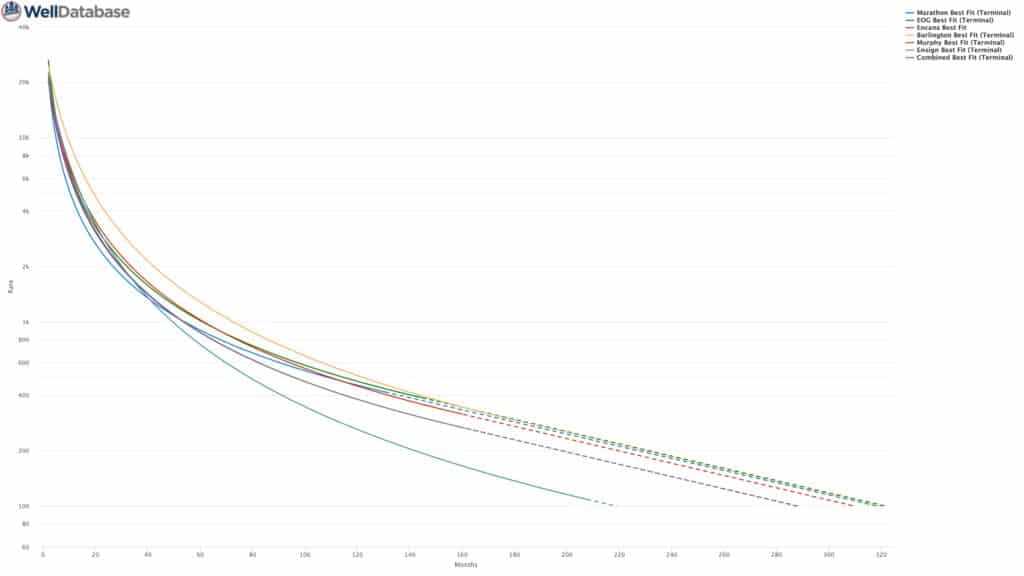

And then the Best Fit + Terminal

Interacting with the data in this view is useful, but the screenshot is a little hard to read. Fortunately, you can export any chart out of WellDatabase into a hi-res image.

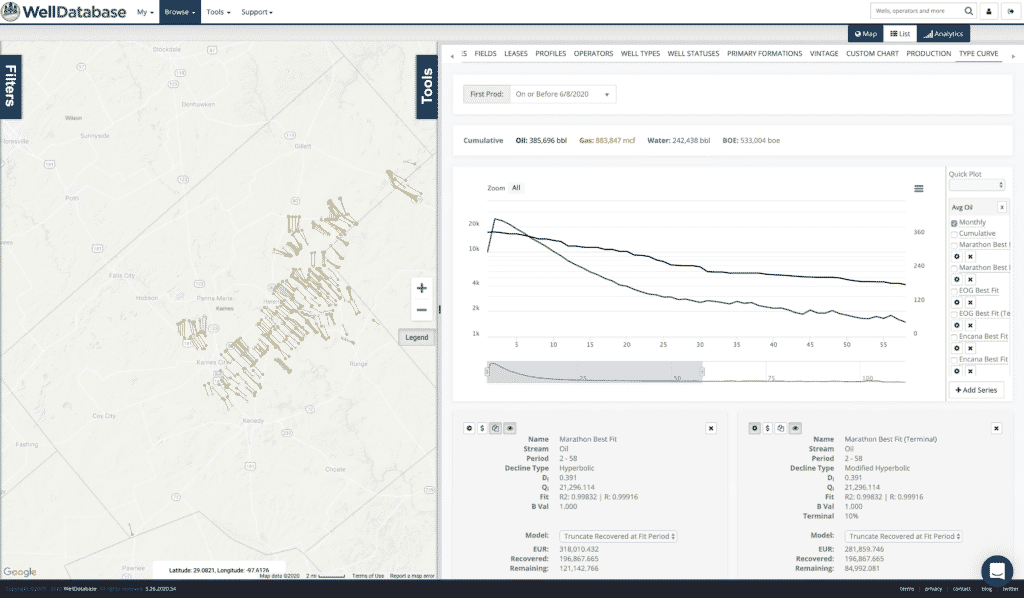

Here’s the Best Fit

And Best Fit + Terminal

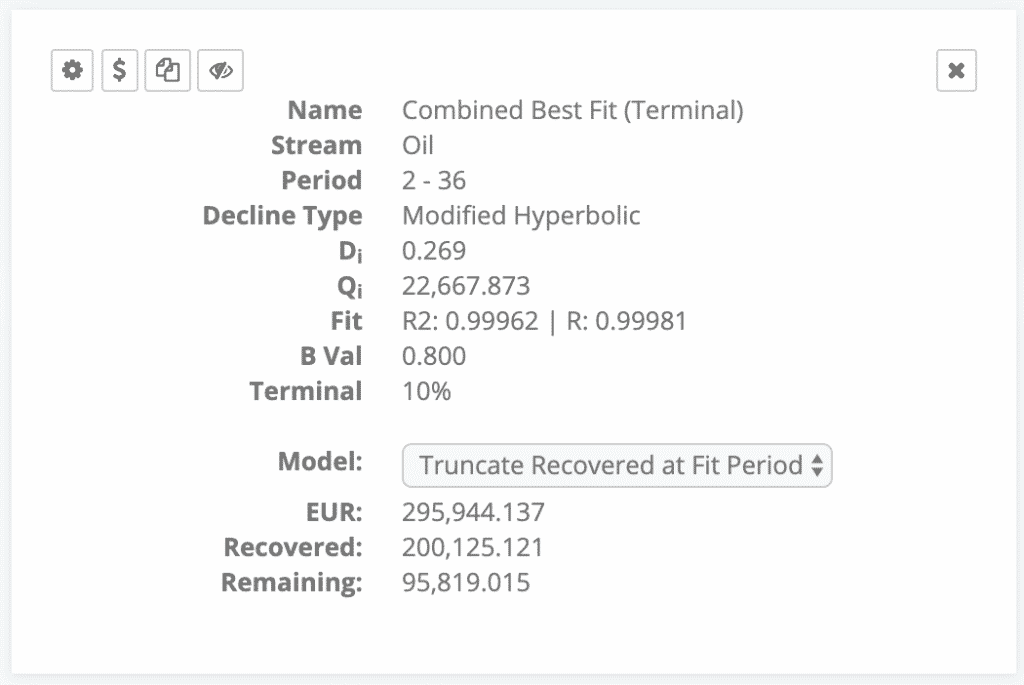

Another useful feature are the DCA summary cards. Here are each of the operator’s cards for the best fit + terminal.

You’ve had to scroll enough already, so we’re going to just lay out some takeaways from this analysis with some simple bullet points.

If you haven’t tried our new DCA tool, sign up today and check it out for yourself. It is available starting in our Essential package ($250/user/month).

Now that we’ve released our updated decline curve analysis tools, it’s time to get into the details. The number one question we get is, “What exactly...

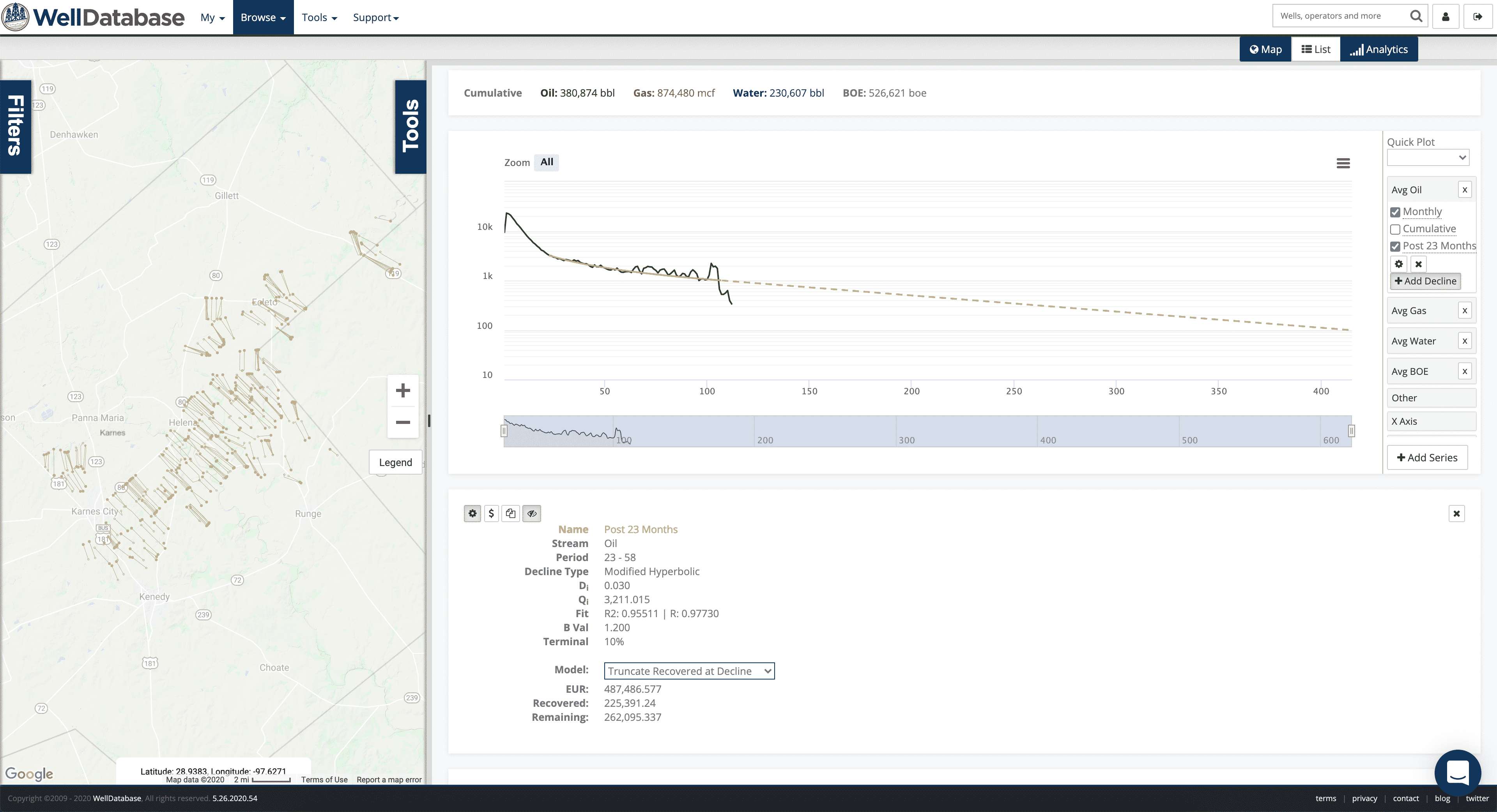

While writing up the post on comparing operators using DCA, we ran across a set of wells where the best fit didn’t exactly fit as well as we would...

Many have called for M&A for years, and 2020 saw a good amount to aid in consolidation of the industry. It has been busier as of late with $3.4...