2023 Permit Activity Recap: Trends, Operators, and Production Insights

As 2023 ends, it's time to reflect on the year and the industry activity. What better way to start than to jump into permitting activity? Let's dive...

You need data. You need mapping. You need tools to analyze that data. Now you can do everything in a single, easy to use platform.

Perfect for users who need access to basic well level data. If you're only interested in a few wells and currently use state sites, this plan is for you.

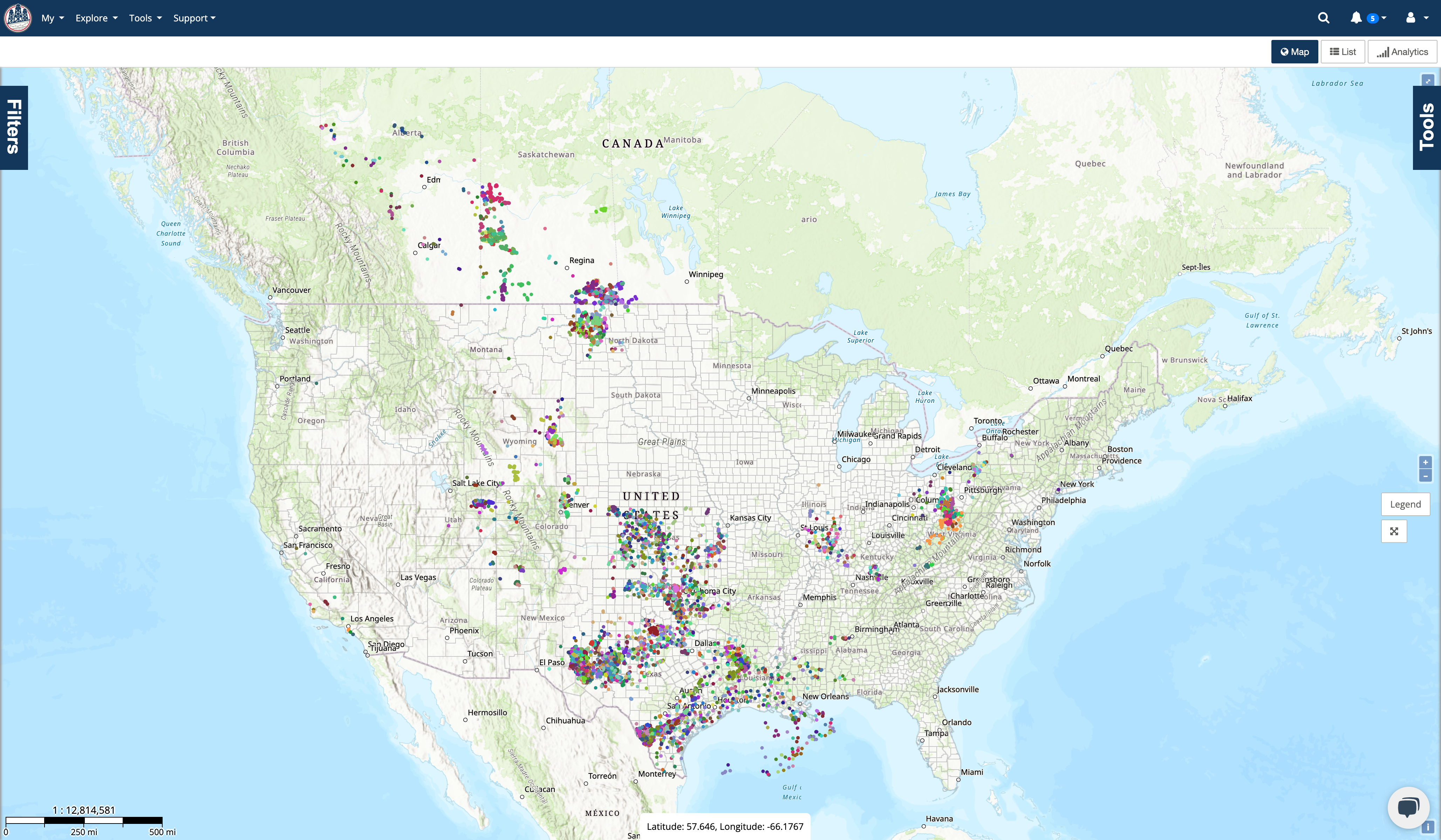

The industry didn't start with unconventionals and neither does our data. We cover the full historical dataset across every producing state and province. Don't settle for inferior data, check out our coverage for any state or province you're interested in.

3 min read

John Ferrell

:

Dec 21, 2023 12:04:27 PM

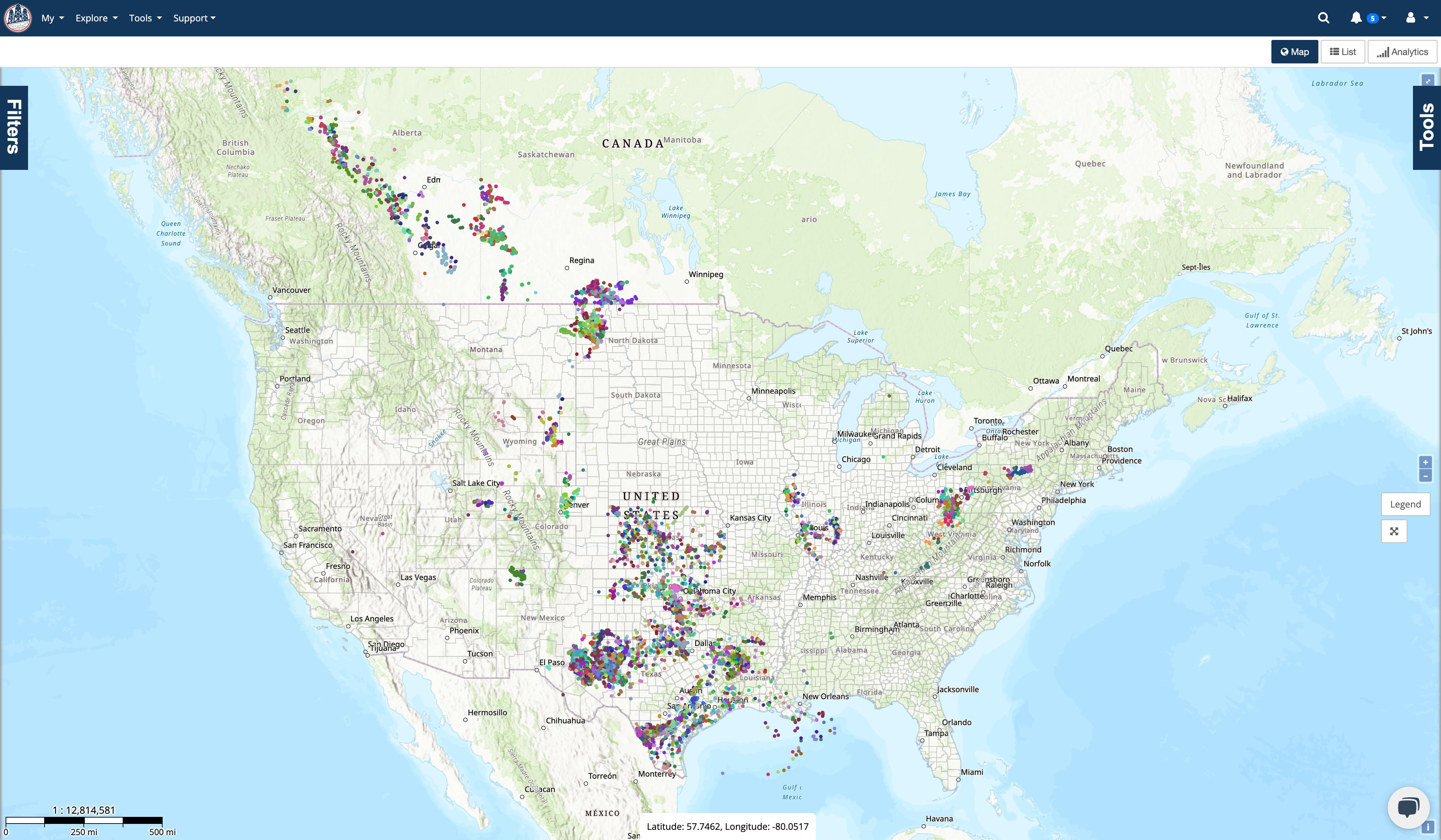

Continuing our 2023 recap series, it's time to discuss completions. If you missed the permit rundown, check that out here - 2023 Permit Activity Recap. 2023 has seen nearly 21,000 completions, a modest bump from around 19,000 in 2022. Remember that the year is ongoing, and some state agencies are notoriously behind (looking at you, New Mexico). Expect these numbers to tick up in the coming months. Let's dive in and see what completions looked like in 2023.

Leading the charge in completions in 2023 is TX (as usual), with over 11,000 completions.

.png?width=740&height=416&name=top-20-state-by-completi%20(1).png)

As to who is doing all this completion work, here is a breakdown of the top 20 operators by completion count.

.png?width=1920&height=1080&name=top-20-current-operator%20(4).png)

Oxy is leading the way, averaging over 100 completions per month in 2023. Note that these are completions of all types, not just new drills.

In the "Duh" category, oil wells make up most of the completions in 2023 (the "OIL WELL" & "GAS WELL" type is designated for wells where we don't have enough data to determine a more granular type). However, a notable number of injection and disposal completions have occurred this year. Over 700 completions were for injection and disposal wells (yes, they're still considered a completion).

.png?width=1920&height=1080&name=top-20-well-type-aliased%20(2).png)

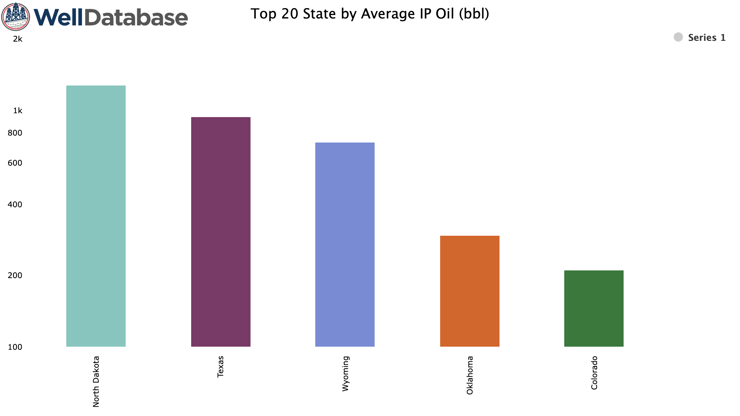

So, the next question is always, how did these completions perform? Considering the early life of these wells, we'll focus on the IP numbers filed with most states' completion documents. Not all states are required to file an IP with their completion, so that will affect the states we can compare.

North Dakota wells narrowly beat out Texas for average oil IP with 1,277 bopd. Remember, this is the average of all completions.

When you break these down by operator, you see that Grayson Mill generates some outstanding IPs in the Bakken.

.png?width=740&height=416&name=top-20-current-operator%20(5).png)

On the gas side, those Louisiana Haynesville wells stand out.

.png?width=740&height=416&name=top-20-state-by-average%20(2).png)

And to no surprise, each of the top operators by Gas IP operates in the Haynesville as well.

.png?width=1920&height=1080&name=top-20-current-operator%20(6).png)

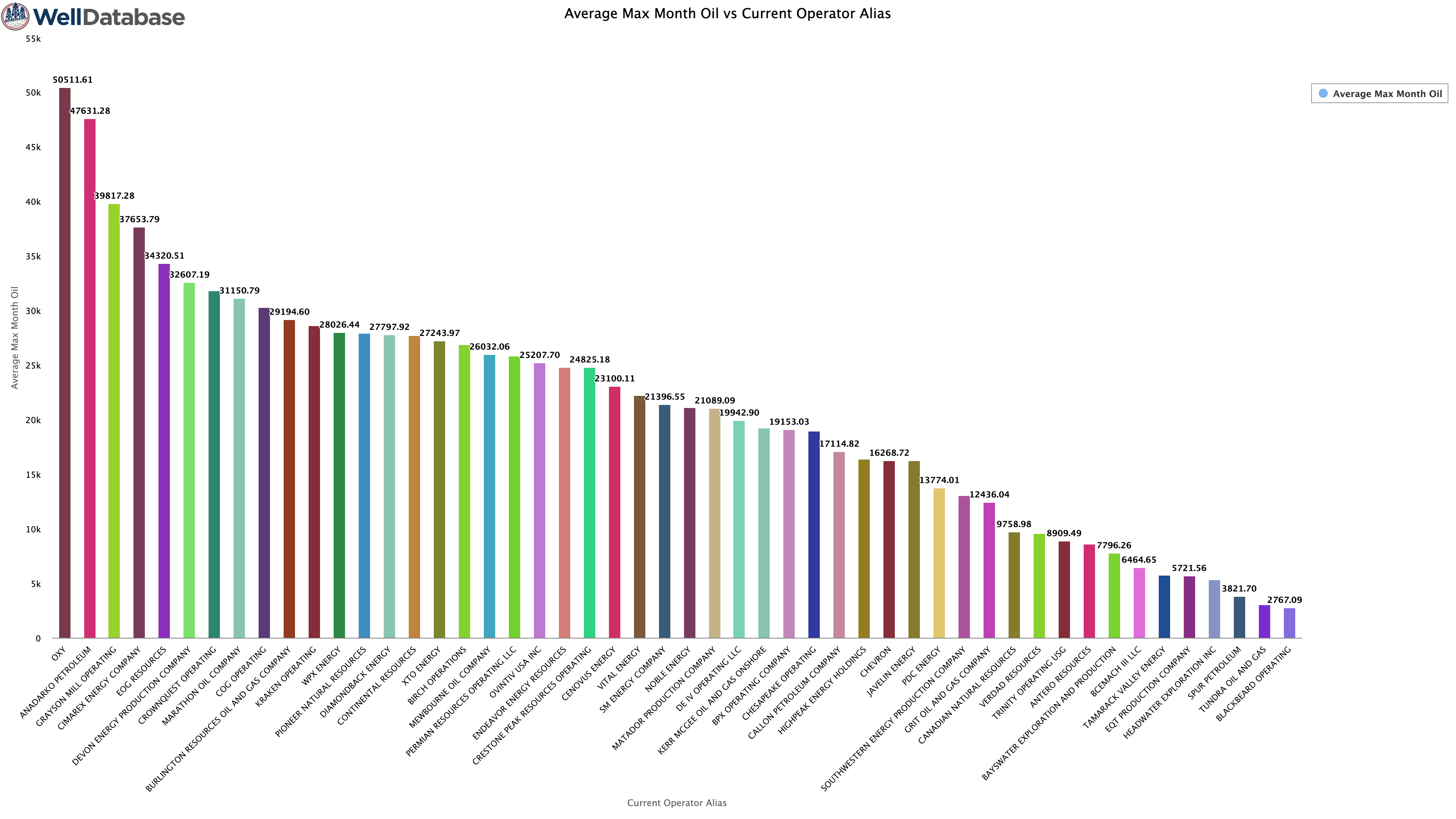

IPs aren't everything, though. Let's look at this year's average monthly production numbers, starting with oil. Due to the large number of operators, we will limit this to the top 50 operators by well count. This will weed out some smaller players, but the chart is hard enough to read with 50.

It looks like Oxy jumps ahead of Grayson Mill when comparing them by maximum monthly production. One very, very important thing to note here is that the production numbers from Oxy will contain many wells allocated from the lease production in Texas. Grayson Mill, on the other hand, is producing in the Bakken, where well-level production is reported. Ideally, any oddities in allocation are evened out by the fact that we're looking at averages, but it is still worth noting.

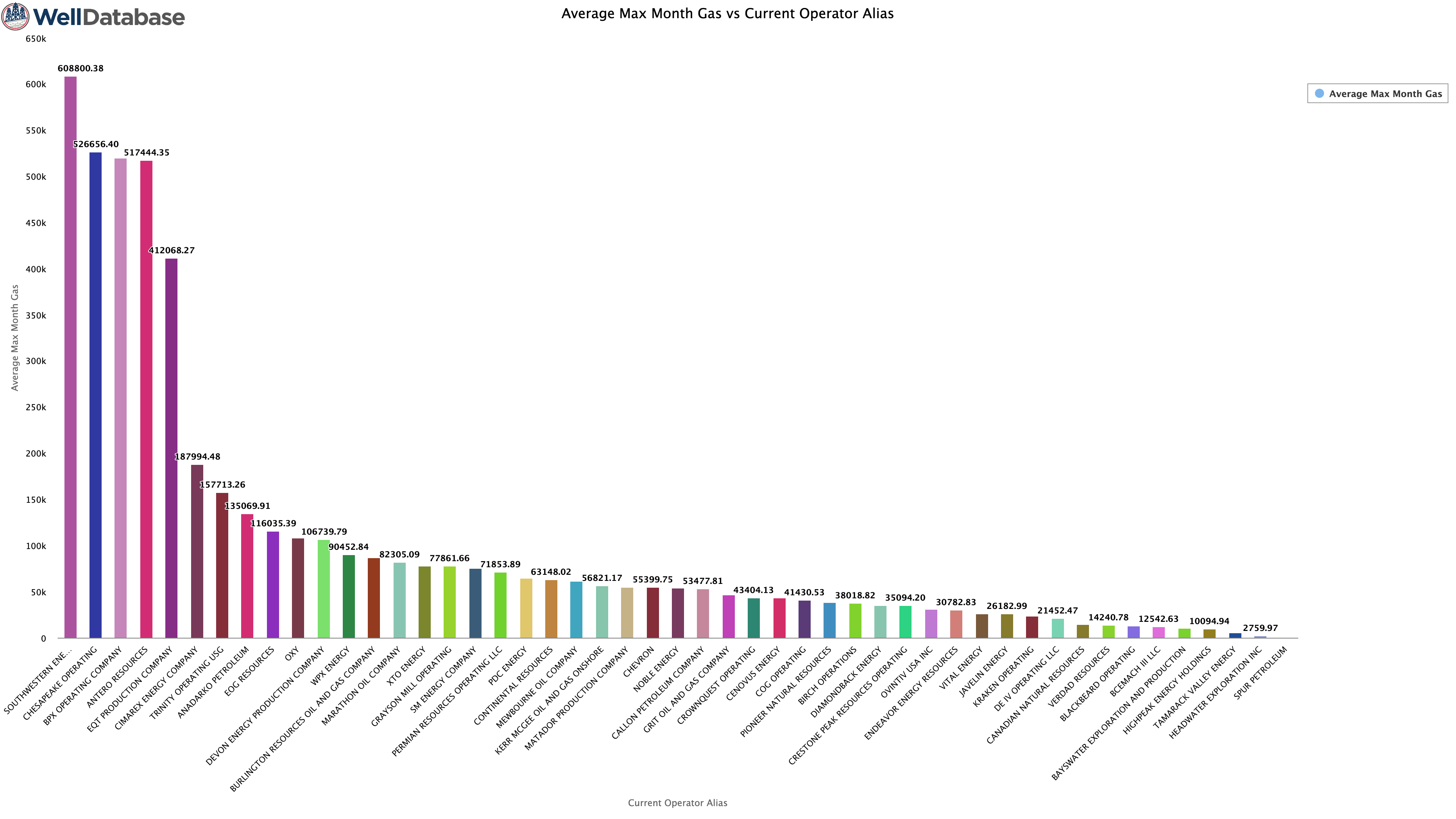

Since we've weeded out the smaller operators, several top Haynesville operators have fallen off this list on the gas side.

It becomes clear we weren't seeing IPs from Appalachia. The northeast operators jump to a definitive lead when looking at maximum monthly gas production, with Southwestern leading the pack in 2023.

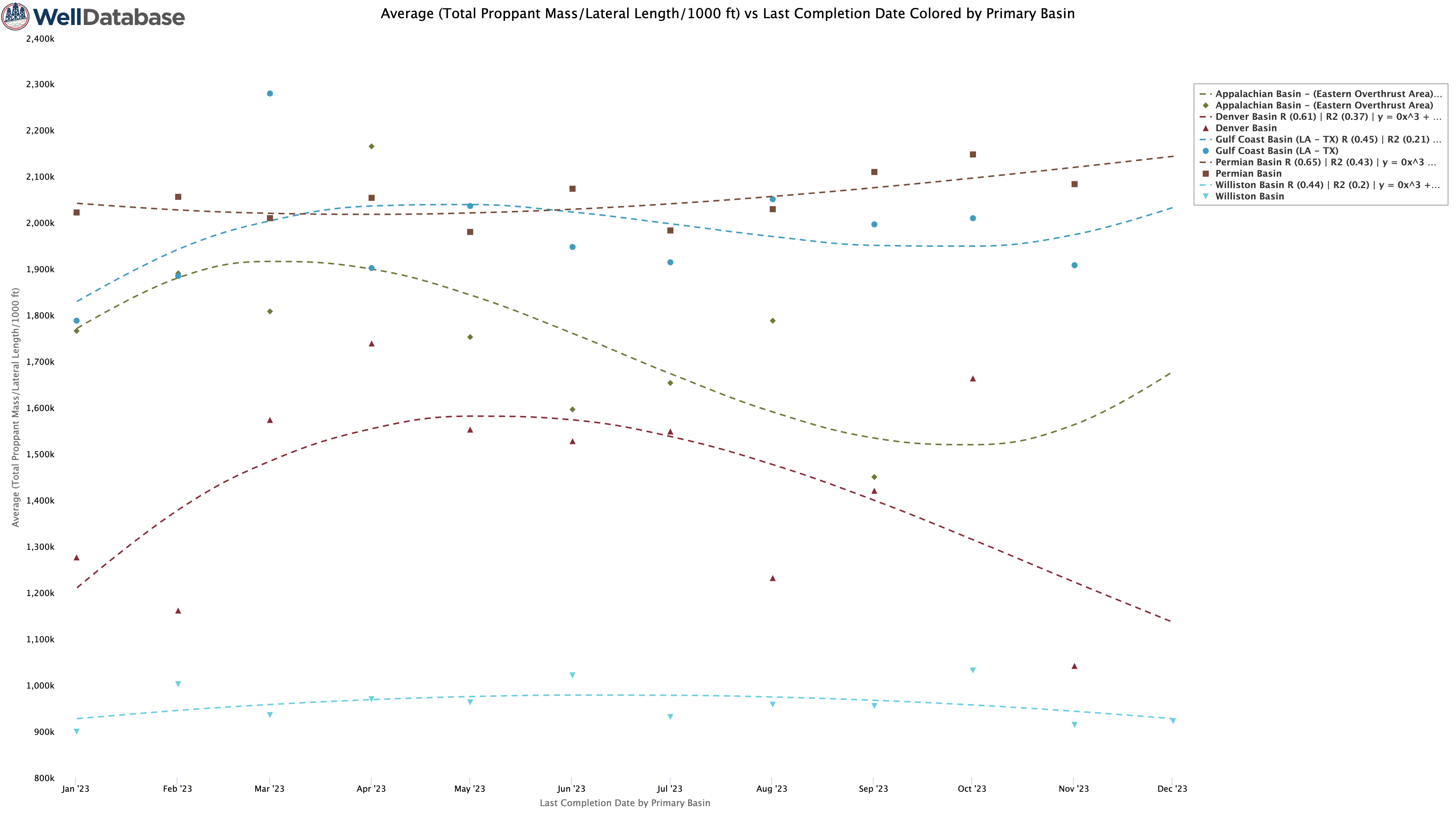

A completion activity recap would only be complete with a look at trends in fracking for 2023. To start, the average frac used a little over 17m gallons of fluid and 16m lbs. of proppant, and it took 14 days from start to finish. The average lateral length was 8,140 ft, so we're looking at an average proppant loading of around 2k lbs./1k lateral ft. The proppant loading becomes more interesting when broken down by basin.

The Permian is the only basin where fracs are consistently at least 2k lbs./1k lateral. The fact that the Permian accounts for most completions pulls this average up across the board. However, the Williston basin fracs don't even surpass 1k lbs./1k lateral, so regional trends here vary significantly (as would costs).

Looking at proppant loading trends over the past 10 years, we see some interesting insights around the evolution of proppant loading in each basin.

.png?width=3840&height=2160&name=average-total-proppant-m%20(1).png)

The Permian has steadily increased the average proppant loading, although the increases have gradually slowed down over the past few years. The Bakken found its sweet spot back in 2019. Notice how the Bakken loading values leveled off after coming down from peak proppant loading ~2018. This isn't every basin, just the top few that accounted for most completions in 2023.

Diving into the details of chemical usage, frac companies, and more, is an interesting topic, but it requires its own detailed post.

2023 has been a year for efficiency. Trends suggest operators are attempting to keep things simple and use what has worked for them in the past. There is not too much in the way of innovation, and that's not necessarily bad. The industry has worked to stabilize after some turbulent years (not just 2020). Overall, we are in a more stable & predictable environment, and completion data in 2023 shows that.

As 2023 ends, it's time to reflect on the year and the industry activity. What better way to start than to jump into permitting activity? Let's dive...

Understanding production patterns and identifying hotspots in oil and gas analytics is crucial for strategic decision-making. Here are some advanced...

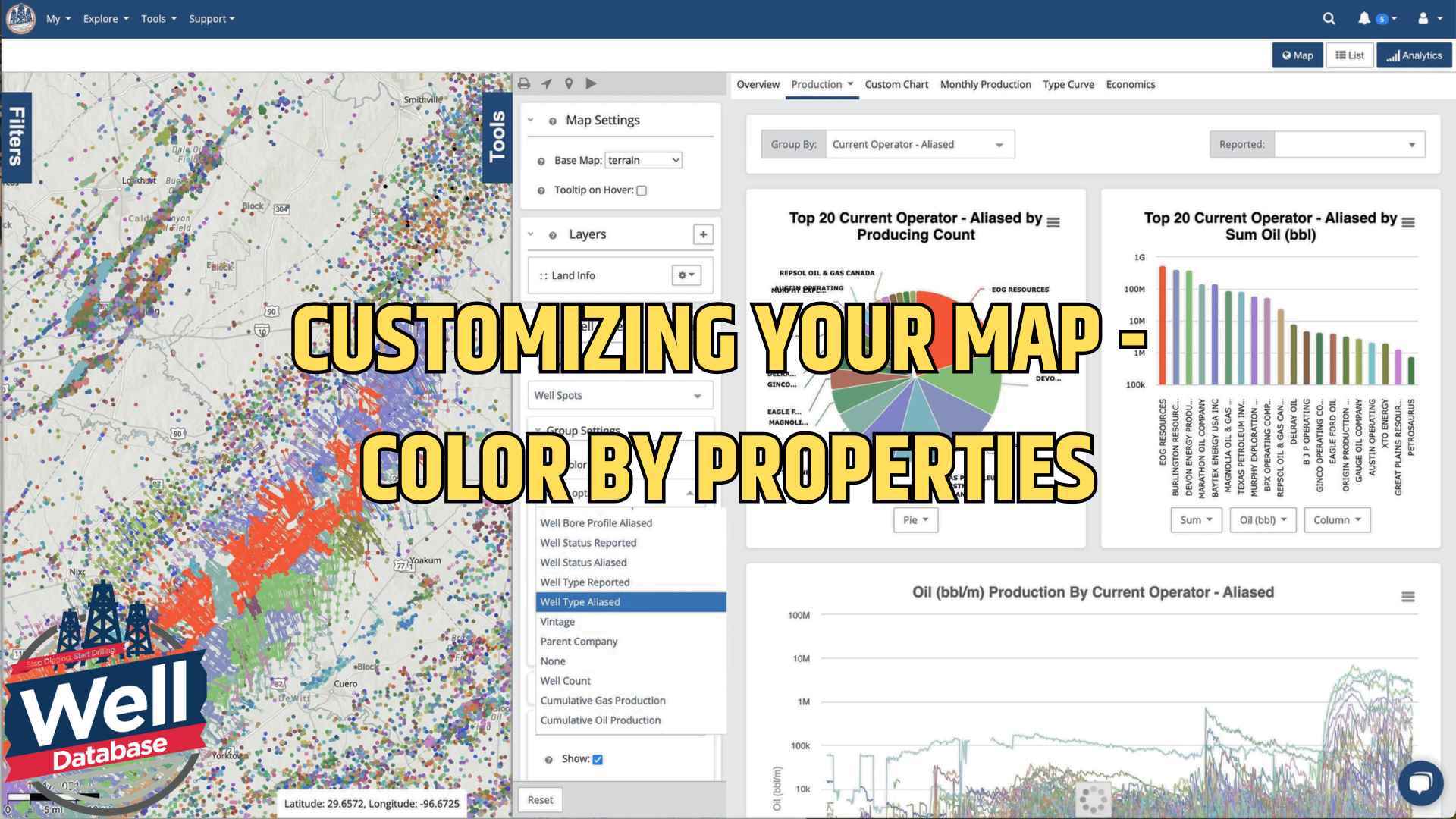

Let me introduce you to one of our most powerful yet user-friendly features: map color customization. Whether you're analyzing well locations,...