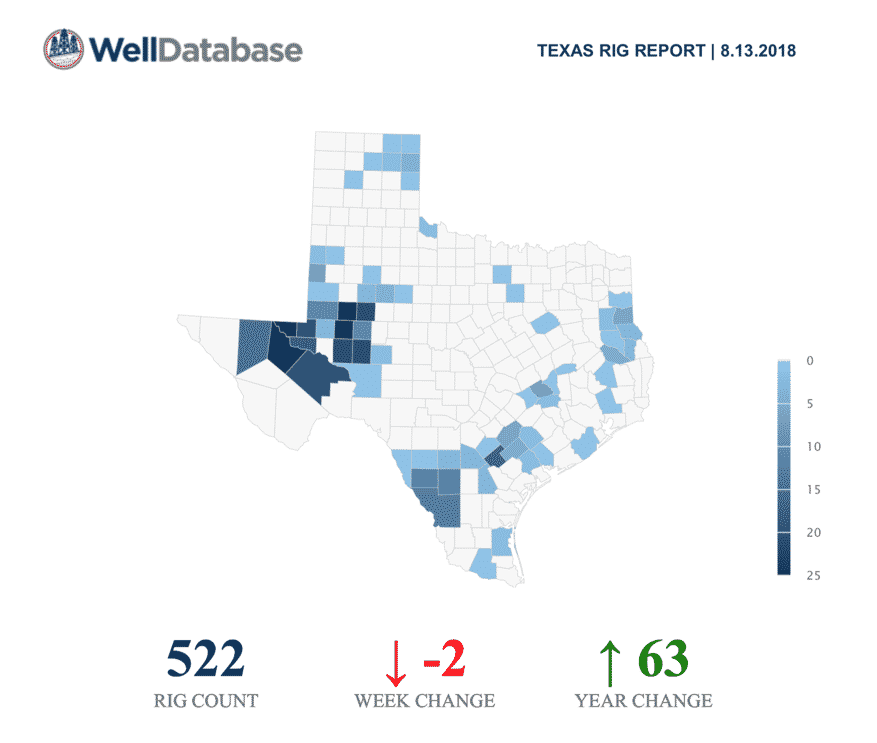

State Rig Report Available

You may have seen our recent announcement about our new Rig Report. Well, in addition to the US rig report, we have also added a break down by state....

You need data. You need mapping. You need tools to analyze that data. Now you can do everything in a single, easy to use platform.

Perfect for users who need access to basic well level data. If you're only interested in a few wells and currently use state sites, this plan is for you.

The industry didn't start with unconventionals and neither does our data. We cover the full historical dataset across every producing state and province. Don't settle for inferior data, check out our coverage for any state or province you're interested in.

Allocating production from the lease level to the well level in the state of Texas can be a challenge. There are a limited number of hard data points and tons of unique cases to be considered. For better or worse, in order to utilize analytics we have to allocate the data to the well level. We provided a quick overview in our Texas Production Allocation Overview. Now we’ll step through an actual lease and watch as the process unfolds.

The lease we are looking at is the Hixon-Trout C Unit lease. If you want to pull the data from the RRC, the lease number is 17284 and the district is 01. This lease has a good sampling of several typical scenarios. The wells on this lease continue to produce, but we will be capping the data on this example to 8/2017. This is enough data to get a full picture of the process. Let’s get started.

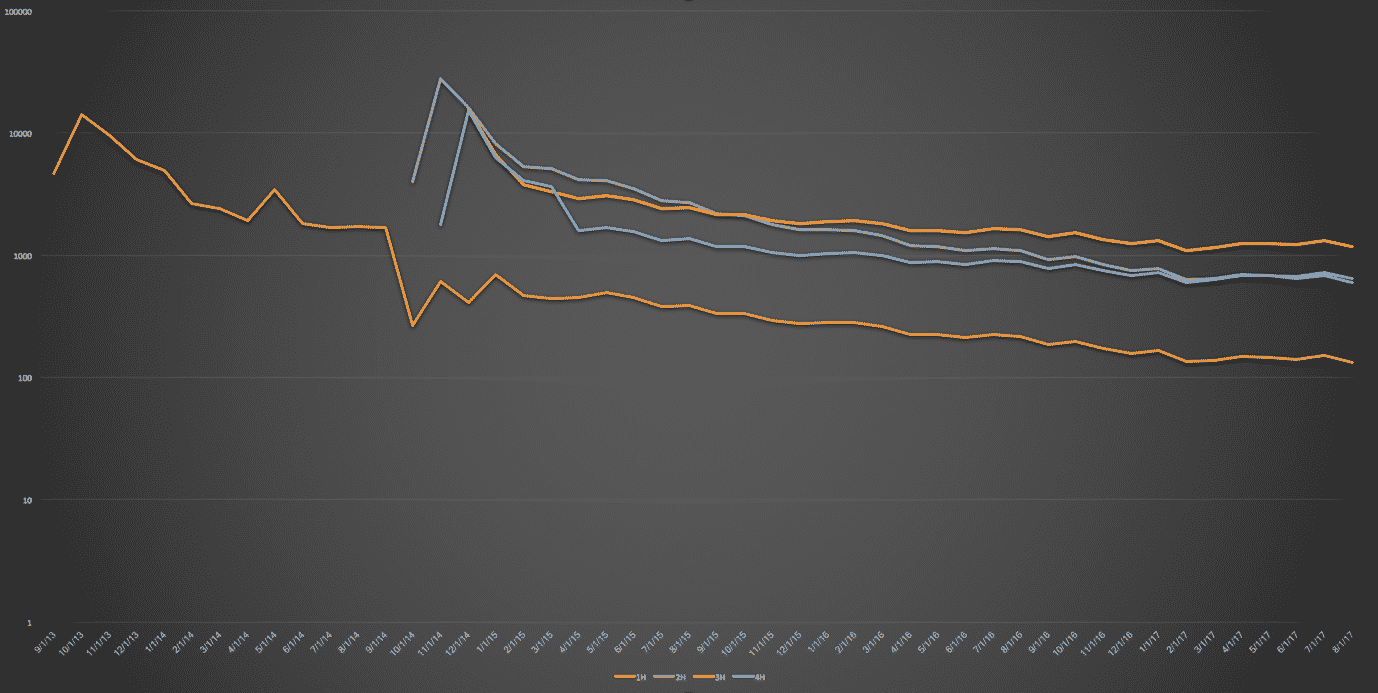

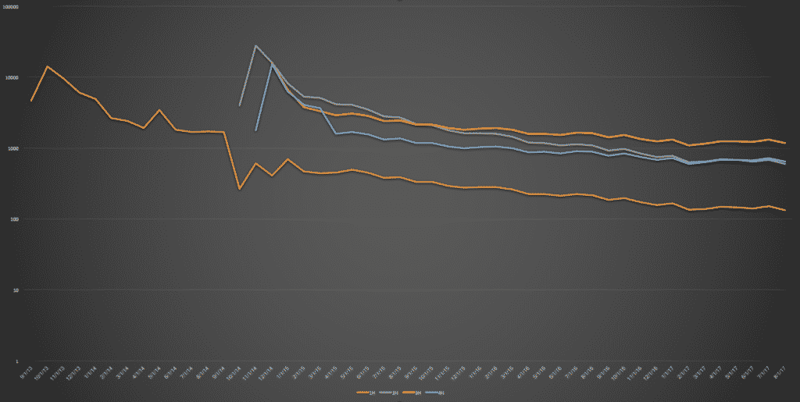

Many leases start with a single well. This is very useful because the lease and well data are the same. In this lease, the 1H well produces for several months before a second well comes online. Here is what that production looks like.

| 1H | ||||

| Report Date | Lease Oil | Known Oil | Calculated Oil | |

| 9/1/13 | 4674 | 4674 | 4674 | |

| 10/1/13 | 14183 | 14183 | 14183 | |

| 11/1/13 | 9563 | 9563 | 9563 | |

| 12/1/13 | 6095 | 6095 | 6095 | |

| 1/1/14 | 4962 | 4962 | 4962 | |

| 2/1/14 | 2652 | 2652 | 2652 | |

| 3/1/14 | 2406 | 2406 | 2406 | |

| 4/1/14 | 1905 | 1905 | 1905 | |

| 5/1/14 | 3472 | 3472 | 3472 | |

The second well is completed on 6/1/2014. At the time of the completion, we have no additional data. Until we get more, we will just continue the decline on the 1H and give the new well what is left over from the lease production

| 1H | 2H | |||||||

| Report Date | Lease Oil | Known Oil | Decline Oil | Calculated Oil | Known Oil | Calculated Oil | ||

| 9/1/13 | 4674 | 4674 | 4674 | |||||

| 10/1/13 | 14183 | 14183 | 14183 | 14183 | ||||

| 11/1/13 | 9563 | 9563 | 9225.645925 | 9563 | ||||

| 12/1/13 | 6095 | 6095 | 6303.645176 | 6095 | ||||

| 1/1/14 | 4962 | 4962 | 4478.808481 | 4962 | ||||

| 2/1/14 | 2652 | 2652 | 3285.084486 | 2652 | ||||

| 3/1/14 | 2406 | 2406 | 2473.946854 | 2406 | ||||

| 4/1/14 | 1905 | 1905 | 1905 | 1905 | ||||

| 5/1/14 | 3472 | 3472 | 1495.045331 | 3472 | ||||

| 6/1/14 | 1823 | 1192.748062 | 1193 | 630 | ||||

| 7/1/14 | 1681 | 965.3209249 | 965 | 716 | ||||

| 8/1/14 | 1701 | 791.1875713 | 791 | 910 | ||||

| 9/1/14 | 1688 | 655.7734276 | 656 | 1032 | ||||

At this point in time, we get an influx of new data that we have to handle.

First, let’s look at the pending lease values as those are known values

| 2H | 4H | |||

| Report Date | Lease Oil | Known Oil | Known Oil | |

| 10/1/14 | 4297 | 4029 | ||

| 11/1/14 | 30469 | 28085 | 1771 | |

| 12/1/14 | 47513 | 16158 | 15379 | |

| 1/1/15 | 21961 | 8264 | 6309 | |

| 2/1/15 | 13721 | 5324 | 4104 | |

| 3/1/15 | 12582 | 5144 | 3652 |

Now we can take the remaining production and allocate it to the other two wells. We do this be continuing the decline on the longest running well (1H) and applying the remainder to the 3H.

| 1H | 3H | |||||||

| Report Date | Lease Oil | Known Values | Decline Oil | Calculated Oil | Calculated Oil | |||

| 10/1/14 | 4297 | 4029 | 192.5301215 | 193 | 75 | |||

| 11/1/14 | 30469 | 29856 | 138.3128645 | 138 | 475 | |||

| 12/1/14 | 47513 | 31537 | 99.36340529 | 99 | 15877 | |||

| 1/1/15 | 21961 | 14573 | 71.3822705 | 71 | 7317 | |||

| 2/1/15 | 13721 | 9428 | 51.28073588 | 51 | 4242 | |||

| 3/1/15 | 12582 | 8796 | 36.83987429 | 37 | 3749 | |||

From here we lose all known values and have to rely exclusively on calculations. We’re in luck though because we have plenty of values to use on our decline curves. We will create decline curves for each well based on the values we have calculated. We will then take those values and assign each well a weight based on the decline value for the period. Finally we take that weight and apply it to the lease production number. This process allows us more accurately account for the movement in lease production and still stay true to the higher producing wells in the lease. Here is what the next nine months look like.

| 1H | 2H | 3H | 4H | ||||||||||||||

| Report Date | Lease Oil | Decline Oil | Decline % | Calculated Oil | Decline Oil | Decline % | Calculated Oil | Decline Oil | Decline % | Calculated Oil | Decline Oil | Decline % | Calculated Oil | ||||

| 4/1/15 | 9093 | 26.46561744 | 0.29% | 27 | 4091.45176 | 45.34% | 4123 | 2484.018237 | 27.53% | 2503 | 2421.179808 | 26.83% | 2440 | ||||

| 5/1/15 | 9392 | 19.01279307 | 0.25% | 24 | 3358.983998 | 44.34% | 4164 | 2125.43735 | 28.06% | 2635 | 2072.017561 | 27.35% | 2569 | ||||

| 6/1/15 | 8399 | 13.65871403 | 0.21% | 17 | 2824.524965 | 43.41% | 3646 | 1857.323144 | 28.55% | 2398 | 1810.869192 | 27.83% | 2338 | ||||

| 7/1/15 | 6902 | 9.812365194 | 0.17% | 11 | 2420.098944 | 42.55% | 2937 | 1649.274681 | 29.00% | 2002 | 1608.18085 | 28.28% | 1952 | ||||

| 8/1/15 | 6911 | 7.049163669 | 0.14% | 9 | 2105.121056 | 41.75% | 2886 | 1483.140383 | 29.42% | 2033 | 1446.298457 | 28.69% | 1983 | ||||

| 9/1/15 | 5849 | 5.064090813 | 0.11% | 7 | 1853.999193 | 41.01% | 2399 | 1347.413123 | 29.81% | 1743 | 1314.026204 | 29.07% | 1700 | ||||

| 10/1/15 | 5811 | 3.638022461 | 0.09% | 5 | 1649.868798 | 40.32% | 2343 | 1234.444845 | 30.17% | 1753 | 1203.920773 | 29.42% | 1710 | ||||

| 11/1/15 | 5070 | 2.613540696 | 0.07% | 4 | 1481.205942 | 39.67% | 2011 | 1138.953962 | 30.51% | 1547 | 1110.840744 | 29.75% | 1508 | ||||

| 12/1/15 | 4695 | 1.877557119 | 0.05% | 3 | 1339.892829 | 39.06% | 1834 | 1057.175785 | 30.82% | 1447 | 1031.120601 | 30.06% | 1411 | ||||

| 1/1/16 | 4812 | 1.348829479 | 0.04% | 3 | 1220.061079 | 38.49% | 1852 | 986.3544264 | 31.12% | 1497 | 962.0766042 | 30.35% | 1460 | ||||

So why only the next nine months? Because in February of 2016, we again get some additional data. This time it comes in the form of test data. Test data is the only hard data point we have to work with once pending lease production is gone (if it was ever in the pending lease set). Typically we see new test records once a year at a minimum. Many times we get more than that. Once we have three test records, we can create a decline model of the test data. Each additional test data point beyond three will improve the accuracy of the model, so we’ll incorporate them as they come in for the life of the well. We will utilize a similar method to assign weights to each well based on the decline model we create from the test data. Creating the decline model on test data is not straight-forward, so we’ll detail that in a later post.

One other big point about generating the test decline model is that the model will now have reference values all the way back to the very first test. This means we will recalculate the production values based off of this model. This also means that we have to go back to the beginning to illustrate how this all comes together. Here is the final look at the lease.

| 1H | 2H | 3H | 4H | ||||||||||||||||||||||

| Report Date | Lease Oil | Known Oil | Test Oil | Test Decline | Test Decline % | Calculated Oil | Known Oil | Test Oil | Test Decline | Test Decline % | Calculated Oil | Known Oil | Test Oil | Test Decline | Test Decline % | Calculated Oil | Known Oil | Test Oil | Test Decline | Test Decline % | Calculated Oil | ||||

| 9/1/13 | 4674 | 4674 | 4674 | ||||||||||||||||||||||

| 10/1/13 | 14183 | 14183 | 26691 | 26691.00 | 100.00% | 14183 | |||||||||||||||||||

| 11/1/13 | 9563 | 9563 | 9842.29 | 100.00% | 9563 | ||||||||||||||||||||

| 12/1/13 | 6095 | 6095 | 5868.72 | 100.00% | 6095 | ||||||||||||||||||||

| 1/1/14 | 4962 | 4962 | 4129.52 | 100.00% | 4962 | ||||||||||||||||||||

| 2/1/14 | 2652 | 2652 | 3163.10 | 100.00% | 2652 | ||||||||||||||||||||

| 3/1/14 | 2406 | 2406 | 2551.55 | 100.00% | 2406 | ||||||||||||||||||||

| 4/1/14 | 1905 | 1905 | 2131.31 | 100.00% | 1905 | ||||||||||||||||||||

| 5/1/14 | 3472 | 3472 | 1825.58 | 100.00% | 3472 | ||||||||||||||||||||

| 6/1/14 | 1823 | 1593.64 | 100.00% | 1823 | |||||||||||||||||||||

| 7/1/14 | 1681 | 1411.94 | 100.00% | 1681 | |||||||||||||||||||||

| 8/1/14 | 1701 | 1265.94 | 100.00% | 1701 | |||||||||||||||||||||

| 9/1/14 | 1688 | 1146.18 | 100.00% | 1688 | |||||||||||||||||||||

| 10/1/14 | 4297 | 1046.25 | 100.00% | 268 | 4029 | 4029 | |||||||||||||||||||

| 11/1/14 | 30469 | 961.67 | 2.61% | 613 | 28085 | 35880 | 35880.00 | 97.39% | 28085 | 1771 | 1771 | ||||||||||||||

| 12/1/14 | 47513 | 1023 | 889.20 | 1.10% | 412 | 16158 | 18446.94 | 22.91% | 16158 | 29171 | 29171.00 | 36.22% | 15564 | 15379 | 32023 | 32023.00 | 39.77% | 15379 | |||||||

| 1/1/15 | 21961 | 826.45 | 3.45% | 699 | 8264 | 12414.90 | 51.79% | 8264 | 6922.62 | 28.88% | 6689 | 6309 | 3807.61 | 15.88% | 6309 | ||||||||||

| 2/1/15 | 13721 | 771.61 | 4.14% | 472 | 5324 | 9355.66 | 50.15% | 5324 | 5506.78 | 29.52% | 3821 | 4104 | 3022.95 | 16.20% | 4104 | ||||||||||

| 3/1/15 | 12582 | 723.29 | 4.61% | 446 | 5144 | 7506.04 | 47.86% | 5144 | 4814.22 | 30.69% | 3340 | 3652 | 2641.04 | 16.84% | 3652 | ||||||||||

| 4/1/15 | 9093 | 680.42 | 4.96% | 451 | 6267.04 | 45.67% | 4153 | 4375.65 | 31.89% | 2899 | 2399.65 | 17.49% | 1590 | ||||||||||||

| 5/1/15 | 9392 | 642.13 | 5.22% | 491 | 5239 | 5379.13 | 43.69% | 4103 | 3379 | 4062.90 | 33.00% | 3099 | 3224 | 2227.70 | 18.09% | 1699 | |||||||||

| 6/1/15 | 8399 | 607.73 | 5.41% | 454 | 4711.59 | 41.92% | 3521 | 3823.91 | 34.02% | 2857 | 2096.39 | 18.65% | 1567 | ||||||||||||

| 7/1/15 | 6902 | 576.68 | 5.55% | 382 | 4191.44 | 40.33% | 2784 | 3632.78 | 34.96% | 2413 | 1991.42 | 19.16% | 1323 | ||||||||||||

| 8/1/15 | 6911 | 279 | 548.50 | 5.65% | 390 | 3774.72 | 38.90% | 2689 | 3474.91 | 35.81% | 2475 | 1904.74 | 19.63% | 1357 | |||||||||||

| 9/1/15 | 5849 | 522.84 | 5.73% | 335 | 3433.37 | 37.61% | 2200 | 3341.33 | 36.60% | 2141 | 1831.42 | 20.06% | 1173 | ||||||||||||

| 10/1/15 | 5811 | 499.36 | 5.78% | 336 | 3148.63 | 36.43% | 2117 | 3226.18 | 37.33% | 2169 | 1768.23 | 20.46% | 1189 | ||||||||||||

| 11/1/15 | 5070 | 477.81 | 5.81% | 294 | 2907.51 | 35.36% | 1793 | 3125.43 | 38.01% | 1927 | 1712.94 | 20.83% | 1056 | ||||||||||||

| 12/1/15 | 4695 | 341 | 457.96 | 5.83% | 274 | 2700.69 | 34.37% | 1613 | 3036.18 | 38.63% | 1814 | 1663.98 | 21.17% | 994 | |||||||||||

| 1/1/16 | 4812 | 439.62 | 5.83% | 281 | 2521.34 | 33.45% | 1610 | 2015 | 2956.33 | 39.22% | 1887 | 1620.18 | 21.50% | 1034 | |||||||||||

| 2/1/16 | 4851 | 422.62 | 5.83% | 283 | 2465 | 2364.33 | 32.60% | 1582 | 2884.27 | 39.77% | 1929 | 1829 | 1580.65 | 21.80% | 1057 | ||||||||||

| 3/1/16 | 4518 | 406.83 | 5.82% | 263 | 2225.72 | 31.81% | 1437 | 2818.75 | 40.29% | 1820 | 1544.72 | 22.08% | 998 | ||||||||||||

| 4/1/16 | 3871 | 392.13 | 5.80% | 224 | 2102.47 | 31.08% | 1203 | 2758.81 | 40.78% | 1579 | 1511.85 | 22.35% | 865 | ||||||||||||

| 5/1/16 | 3897 | 434 | 378.41 | 5.77% | 225 | 1992.15 | 30.39% | 1184 | 1395 | 2703.67 | 41.24% | 1607 | 1481.60 | 22.60% | 881 | ||||||||||

| 6/1/16 | 3707 | 365.56 | 5.74% | 213 | 1920 | 1892.83 | 29.74% | 1102 | 2652.68 | 41.68% | 1545 | 1453.65 | 22.84% | 847 | |||||||||||

| 7/1/16 | 3902 | 353.53 | 5.71% | 223 | 1802.95 | 29.13% | 1137 | 2605.34 | 42.09% | 1642 | 1427.68 | 23.07% | 900 | ||||||||||||

| 8/1/16 | 3814 | 342.22 | 5.68% | 217 | 1721.21 | 28.55% | 1089 | 2561.20 | 42.49% | 1620 | 1302 | 1403.48 | 23.28% | 888 | |||||||||||

| 9/1/16 | 3288 | 331.58 | 5.64% | 186 | 1646.56 | 28.01% | 921 | 2519.91 | 42.86% | 1409 | 1380.84 | 23.49% | 772 | ||||||||||||

| 10/1/16 | 3523 | 321.56 | 5.60% | 197 | 1578.12 | 27.49% | 969 | 2481.16 | 43.22% | 1523 | 1359.60 | 23.68% | 834 | ||||||||||||

| 11/1/16 | 3112 | 312.09 | 5.56% | 173 | 1515.14 | 27.00% | 840 | 2444.69 | 43.57% | 1356 | 1339.60 | 23.87% | 743 | ||||||||||||

| 12/1/16 | 2834 | 303.14 | 5.52% | 156 | 1457 | 1457.00 | 26.53% | 752 | 2410.27 | 43.89% | 1244 | 1320.73 | 24.05% | 682 | |||||||||||

| 1/1/17 | 3007 | 294.67 | 5.48% | 166 | 1403.15 | 26.09% | 784 | 2377.71 | 44.21% | 1329 | 1302.89 | 24.22% | 728 | ||||||||||||

| 2/1/17 | 2468 | 286.63 | 5.44% | 134 | 1353.14 | 25.66% | 633 | 2346.85 | 44.51% | 1099 | 1285.96 | 24.39% | 602 | ||||||||||||

| 3/1/17 | 2576 | 279 | 279.00 | 5.39% | 139 | 1306.58 | 25.26% | 651 | 2263 | 2317.52 | 44.80% | 1154 | 1240 | 1269.89 | 24.55% | 632 | |||||||||

| 4/1/17 | 2785 | 271.75 | 5.35% | 149 | 1263.11 | 24.87% | 693 | 2289.61 | 45.08% | 1255 | 1254.59 | 24.70% | 688 | ||||||||||||

| 5/1/17 | 2761 | 264.84 | 5.31% | 147 | 1222.44 | 24.50% | 676 | 2263.00 | 45.35% | 1252 | 1240.00 | 24.85% | 686 | ||||||||||||

| 6/1/17 | 2676 | 258.27 | 5.26% | 141 | 1184.31 | 24.14% | 646 | 2237.58 | 45.61% | 1220 | 1226.07 | 24.99% | 669 | ||||||||||||

| 7/1/17 | 2881 | 251.99 | 5.22% | 150 | 1148.48 | 23.80% | 686 | 2213.27 | 45.86% | 1321 | 1212.74 | 25.13% | 724 | ||||||||||||

| 8/1/17 | 2554 | 246.00 | 5.18% | 133 | 1114.76 | 23.47% | 599 | 2189.98 | 46.10% | 1177 | 1199.97 | 25.26% | 645 | ||||||||||||

Here is a chart for the calculated production

Conclusion

As you can tell from this example, our process is straightforward, logical, and effective. We are very happy with the finished product, but we know there is always room for improvement. If you have any feedback at all, please let us know.

You may have seen our recent announcement about our new Rig Report. Well, in addition to the US rig report, we have also added a break down by state....

.png)

In the oil and gas industry, data visualization is a game-changer. It empowers operators to make faster, smarter decisions by combining complex...